Farm Credit Bank of Texas reports third-quarter 2023 financial results

FOR IMMEDIATE RELEASE November 2, 2023

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported loan growth and strong credit quality in the first nine months of 2023.

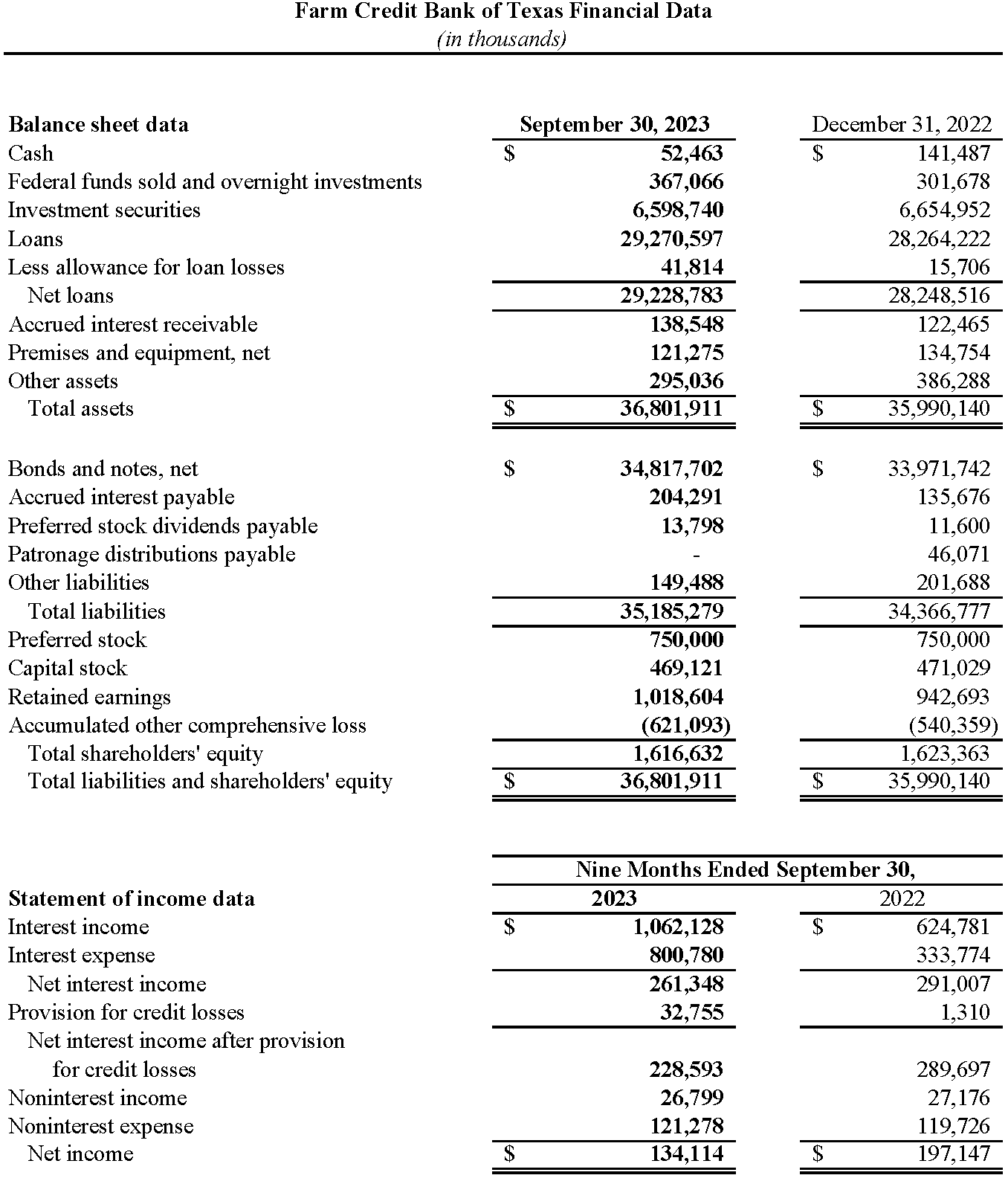

Total loan volume was $29.3 billion at Sept. 30, 2023, an increase of 3.6% since the end of 2022. Loan growth reflected increases of $925.8 million in direct notes to the bank’s affiliated lending institutions and $80.6 million in loan participations. Total assets increased 2.3% over the same period to $36.8 billion. Overall credit quality remained high, with 99.5% of loans classified as acceptable or special mention, compared with 99.7% at year-end.

“Our asset growth is returning to more moderate levels following a period of rapid growth and historically low interest rates,” said Amie Pala, FCBT chief executive officer. “We’re seeing lower earnings on our assets due to the interest rate environment and additional provision for credit losses resulting from inflationary pressure on borrowers, but that is to be expected in the current economic cycle.”

Net interest income was $261.3 million for the nine months ending Sept. 30, 2023, a decrease of 10.2% compared with the same period of 2022. The change reflects a decrease of 18 basis points in net interest margin, partially offset by a $2.1 billion increase in the bank’s average earning assets.

The bank recognized a $32.8 million provision for credit losses for the first nine months of the year, reflecting an increase in specific reserves associated with a limited number of borrowers. Nonperforming assets, which consisted of nonaccrual loans and accruing loans 90 days or more past due, represented 0.18% of total loans, compared with 0.11% at year-end.

Year-to-date net income was $134.1 million, a 32.0% decrease year over year. The change was primarily due to the aforementioned increase in provision for credit losses and decrease in net interest income.

“Although inflation has eased somewhat, borrowers in our five-state district continue to feel the impact of rising input and borrowing costs,” said Jimmy Dodson, FCBT board chair. “It is during trying times that rural communities and agriculture most need a source of dependable credit and financial services like Farm Credit.”

At the end of the third quarter the bank had $1.6 billion in shareholders’ equity and a total capital ratio of 13.23%. Cash and investments totaled $7.0 billion. Capital and liquidity remain above regulatory requirements.

The bank is part of the Farm Credit System, a nationwide network of rural lending cooperatives established in 1916. The System reported combined net income of $5.5 billion for the nine months ending Sept. 30, 2023, compared with $5.4 billion a year earlier.

These financial results are preliminary and unaudited. The bank will post its 2023 third-quarter report at https://www.farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 14 local lending cooperatives and two other financing institutions, enabling them to make loans to farmers, ranchers, agribusinesses and rural property owners. The bank also partners with other lenders to finance agricultural production and processing, essential rural infrastructure and more.