Farm Credit Bank of Texas Reports Second Quarter 2019 Financial Results

For Immediate Release August 2, 2019

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported solid earnings, positive loan growth and strong credit quality in the second quarter of 2019.

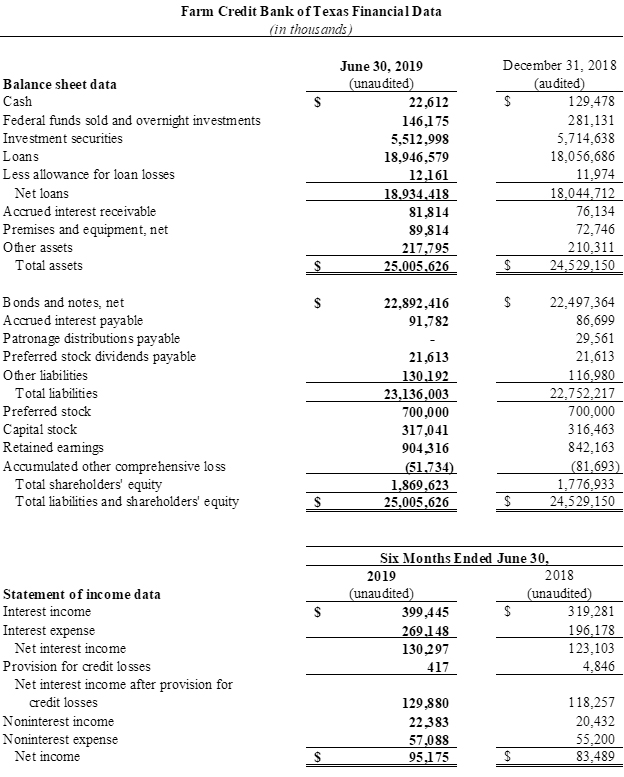

Total loan volume increased 2.5% in the second quarter and 4.9% since year end, resulting in record loan volume of $18.9 billion at June 30, 2019. Total assets exceeded $25.0 billion for the first time in the bank’s history. Credit quality was 99.5% of loans classified as acceptable or special mention.

Net income for the first six months of 2019 totaled $95.2 million, a 14.0% increase over the same period of 2018. The bank reported $130.3 million in net interest income for the first six months of the year, a 5.8% increase over the same period of 2018 due to a $1.6 billion increase in average earning assets.

“Our steady growth, diversified portfolios and strong economic conditions in the Texas District contributed to solid midyear financial results,” said Larry Doyle, FCBT chief executive officer. “We also took advantage of the rate environment by calling $1.9 billion in debt in the first half of the year and issuing new debt at lower rates.”

At the end of the second quarter, shareholders’ equity totaled $1.9 billion. Cash and investments totaled $5.7 billion, providing 232 days of liquidity.

Farm Credit Bank of Texas — a cooperatively owned wholesale funding bank in Austin, Texas — provides funding and support services to 14 Farm Credit lending cooperatives in five states and two other financing institutions. Those lenders, in turn, provide credit and financial services to farmers, ranchers, rural homeowners and landowners, and agribusinesses.

“Our territory is home to a vibrant and diverse agriculture industry,” said FCBT Board Chairman Jimmy Dodson. “Centralizing key services at the bank frees our affiliated lenders to focus on serving local ag producers and rural communities.”

The bank is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. The System reported combined net income of $1.4 billion and $2.7 billion for the three months and six months ended June 30, 2019, compared with $1.4 billion and $2.6 billion a year earlier.

The financial results discussed herein are preliminary and unaudited.