Farm Credit Bank of Texas reports midyear 2023 financial results

FOR IMMEDIATE RELEASE August 2, 2023

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported solid loan growth and credit quality in the first six months of 2023.

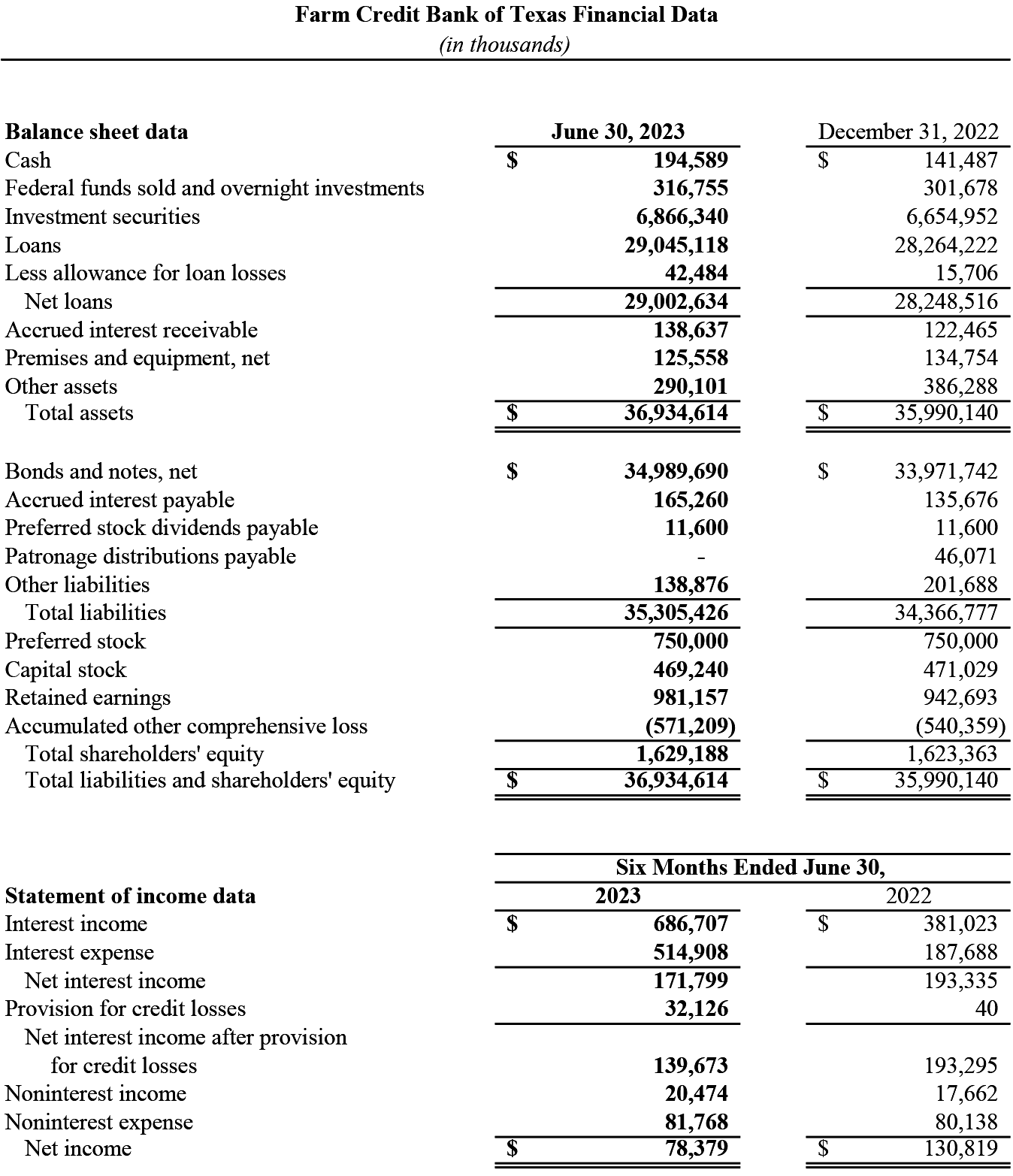

Total loan volume was $29.0 billion at June 30, 2023, an increase of 2.8% since the end of 2022. Total assets increased 2.6% over the same period to $36.9 billion. Overall credit quality remained high, with 99.5% of loans classified as acceptable or special mention, compared with 99.7% at year-end.

“The bank has continued to perform well in a challenging environment for lenders and borrowers,” said Amie Pala, FCBT chief executive officer. “While our net interest margin has decreased and nonperforming loans have increased since year-end, as expected amid volatile interest rates and inflation, we are generating earnings and maintaining strong credit quality.”

Net interest income was $171.8 million for the six months ending June 30, 2023, a decrease of 11.1% compared with the same period of 2022. The change was driven primarily by a decrease of 25 basis points in net interest rate spread, partially offset by a $2.4 billion increase in the bank’s average earning assets.

The bank recognized a $32.1 million provision for credit losses for the first six months of the year. The provision primarily reflected specific reserves associated with a limited number of borrowers in the agribusiness, production and intermediate term, and energy sectors. Nonperforming assets, which consisted of nonaccrual loans and accruing loans 90 days or more past due, represented 0.26% of total loans, compared with 0.11% at year-end.

Year-to-date net income was $78.4 million, a 40.1% decrease year over year. The change was primarily due to the aforementioned increase in provision for credit losses and a decrease in net interest income.

“The bank provides funding, technology and support services that local Farm Credit lending cooperatives use to serve their customers,” said Jimmy Dodson, FCBT board chair. “In the second quarter, we completed the delivery of the bank’s FarmView® technology platform for sales, loan origination, servicing and loan accounting to three more of our affiliated co-ops — a significant accomplishment.”

At the end of the second quarter the bank had $1.6 billion in shareholders’ equity, a total capital ratio of 12.96%, and cash and investments of $7.4 billion. Capital and liquidity remain above regulatory requirements.

The bank is part of the Farm Credit System , a nationwide network of cooperatives established in 1916. The System reported combined net income of $3.51 billion for the six months ending June 30, 2023, compared with $3.57 billion for the same period last year.

These financial results are preliminary and unaudited. The bank will post its 2023 second-quarter financial report at www.farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 14 local lending cooperatives and two other financing institutions, enabling them to make loans to farmers, ranchers, agribusinesses and rural property owners. The bank also partners with other lenders to finance agricultural production and processing, essential rural infrastructure and more.