Farm Credit Bank of Texas reports first-quarter 2023 financial results

FOR IMMEDIATE RELEASE May 3, 2023

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported solid loan growth and continued strong credit quality in the first quarter of 2023.

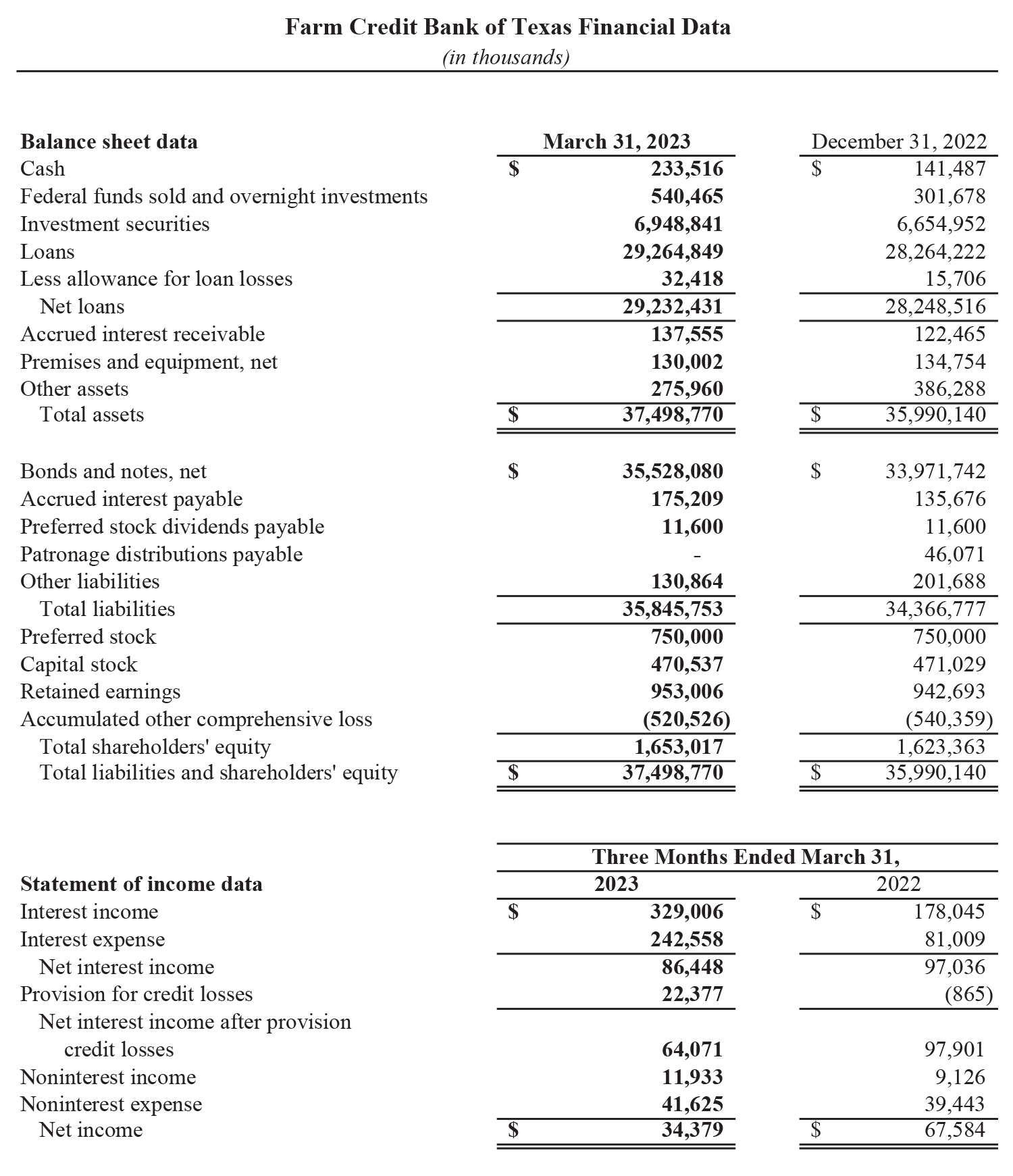

Total loan volume rose 3.5% to $29.3 billion at March 31, 2023, reflecting steady growth. Overall credit quality remained stable at 99.7% acceptable or special mention at March 31, unchanged since year-end. Total assets were $37.5 billion, up 4.2% from Dec. 31, 2022.

“The bank’s credit quality remains strong despite the challenges of higher commodity prices, inflationary pressures and higher interest rates,” said Amie Pala, FCBT chief executive officer. “The Federal Reserve’s rapid rise in market interest rates is placing pressure on the bank’s earnings compared with a year ago. The bank remains financially resilient in this volatile market environment and continues its mission of providing credit for agriculture and rural America.”

Net interest income for the quarter was $86.4 million, a 10.9% decrease year over year. The change was driven primarily by a 26 basis point decrease in net interest rate spread, partially offset by a $2.7 billion increase in the bank’s average earning assets.

On Jan. 1, 2023, the bank adopted a new accounting standard for credit loss reserves. During the quarter, the bank recorded $22.4 million of provision for credit losses resulting from credit deterioration with select borrowers in the agribusiness and energy sectors.

First-quarter net income was $34.4 million, a 49.4% decrease compared with the same period of 2022. The change reflects a decrease in net interest income, the increase in provision for credit losses and an increase in noninterest expense, partially offset by an increase in noninterest income.

At the end of the first quarter the bank had $1.7 billion in shareholders’ equity and a total capital ratio of 12.53%. Cash and liquidity investments totaled $7.7 billion. Both capital and liquidity are strong and well above regulatory requirements.

“Inflation has made it more expensive to produce, process and market agricultural products,” said Jimmy Dodson, FCBT board chair. “The need for a source of reliable, consistent credit for agriculture and rural communities in all market environments is why the Farm Credit System was established over a century ago.”

The bank is part of the Farm Credit System , a nationwide network of cooperatives established in 1916. The System reported combined net income of $1.7 billion for the three months ending March 31, 2023, compared with $1.8 billion for the same period last year.

These financial results are preliminary and unaudited. The bank will post its 2023 first-quarter report at https://www.farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 14 local lending cooperatives and two other financing institutions, enabling them to make loans to farmers, ranchers, agribusinesses and rural property owners. The bank also partners with other lenders to finance agricultural production and processing, essential rural infrastructure and more.