Bank Reports Loan Growth in Second Quarter

For Immediate Release August 4, 2017

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a wholesale bank that funds 14 rural lending cooperatives in five states, reported growth in earnings and loan volume in the second quarter of 2017.

The bank has a diversified loan portfolio consisting largely of direct notes to Farm Credit cooperatives that lend to farmers, ranchers and other rural borrowers. It also participates with other lenders in loans to businesses that ag producers and rural communities rely on, such as food processors, agribusinesses and rural infrastructure companies.

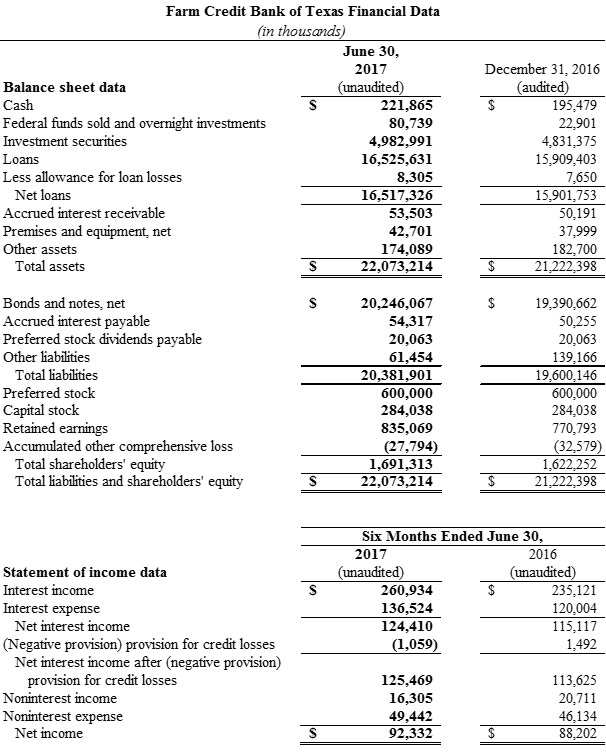

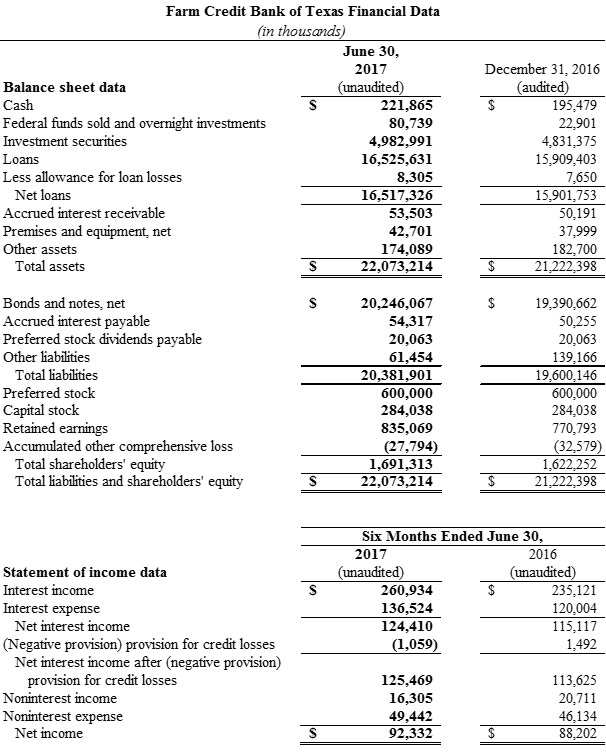

Loan demand in the rural communities in the bank’s territory contributed to a record $16.5 billion in total loan volume and $22.1 billion in total assets at June 30, 2017, increases of 3.9 percent and 4.0 percent since year-end. Credit quality remained very strong, with 99.8 percent of the bank’s overall portfolio considered acceptable or special mention.

“Our year-to-date earnings exceeded our projections due to asset growth,” said Larry Doyle, FCBT chief executive officer. “The continued demand for loans reflects the economic stability in our five-state territory, which is home to a vibrant and diverse agriculture industry.”

Net interest income was $62.7 million and $124.4 million for the three months and six months ended June 30, 2017, increases of 7.7 percent and 8.1 percent compared with the same periods in 2016. The bank reported net income of $45.6 million for the quarter, a 1.2 percent decrease year over year due largely to an increase in operating expenses and a nonrecurring gain on the sale of an asset in 2016. Earnings for the six months ended June 30, 2017, totaled $92.3 million, a 4.7 percent increase year over year.

Capital and liquidity continue to exceed the regulatory requirements set by the bank’s federal regulator, the Farm Credit Administration. At June 30, 2017, the bank had a permanent capital ratio of 16.05 percent, tier 1 capital ratio of 16.04 percent and shareholders’ equity of $1.7 billion. Cash and investments totaled $5.3 billion, providing 208 days of liquidity.

“As a financial institution and cooperative owned by the customers we serve, the bank has a duty to manage capital responsibly,” said FCBT Board Chairman Jimmy Dodson. “Our careful approach to risk helps us carry out Farm Credit’s mission to ensure that agriculture and rural communities have access to a stable, reliable source of funding.”

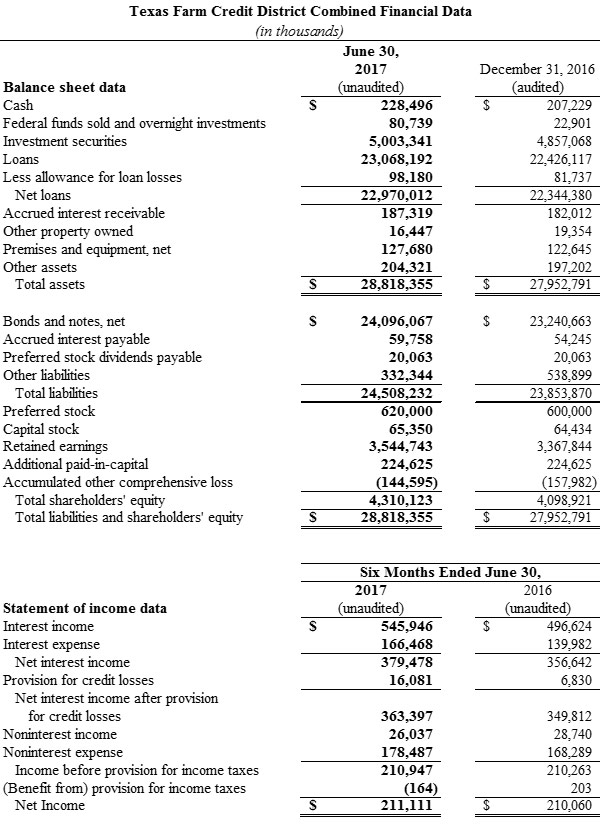

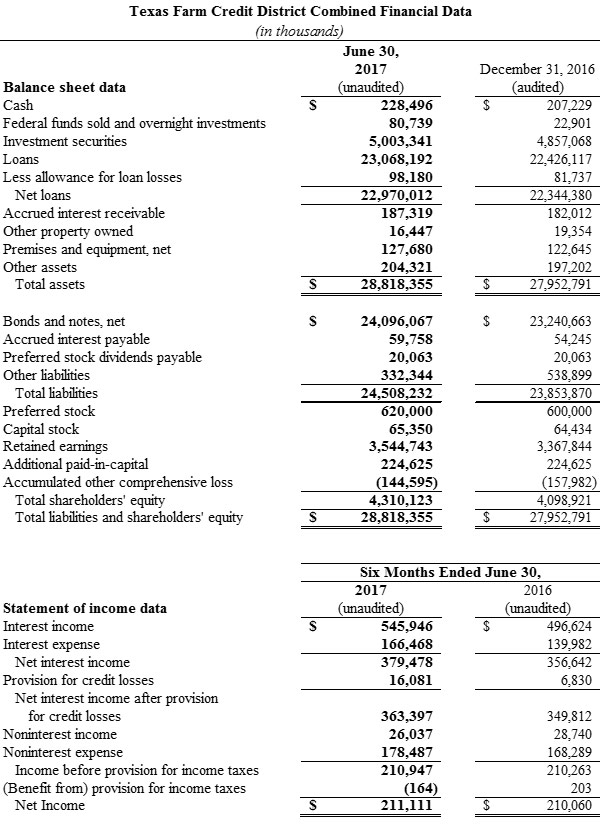

The bank and its affiliated lending cooperatives across Alabama, Louisiana, Mississippi, New Mexico and Texas constitute the Texas Farm Credit District. Collectively, the district institutions reported $23.1 billion in loans and $28.8 billion in total assets at June 30, 2017, increases of 2.9 percent and 3.1 percent, respectively, since the end of 2016. Credit quality remained strong, with 98.4 percent of district loans classified as acceptable or special mention.

The district reported combined net income of $99.4 million and $211.1 million for the three months and six months ended June 30, 2017, increases of 10.8 percent and 0.5 percent compared with the same periods in 2016.

The district is part of the Farm Credit System, a nationwide network of lending cooperatives established in July 1916. Nationally, the System reported combined net income of $1.24 billion and $2.48 billion for the three-month and six-month periods ended June 30, 2017, compared with $1.18 billion and $2.34 billion for the same periods in 2016.