Farm Credit Bank of Texas Distributes Over 90% of 2019 Earnings

For immediate release: February 21, 2020

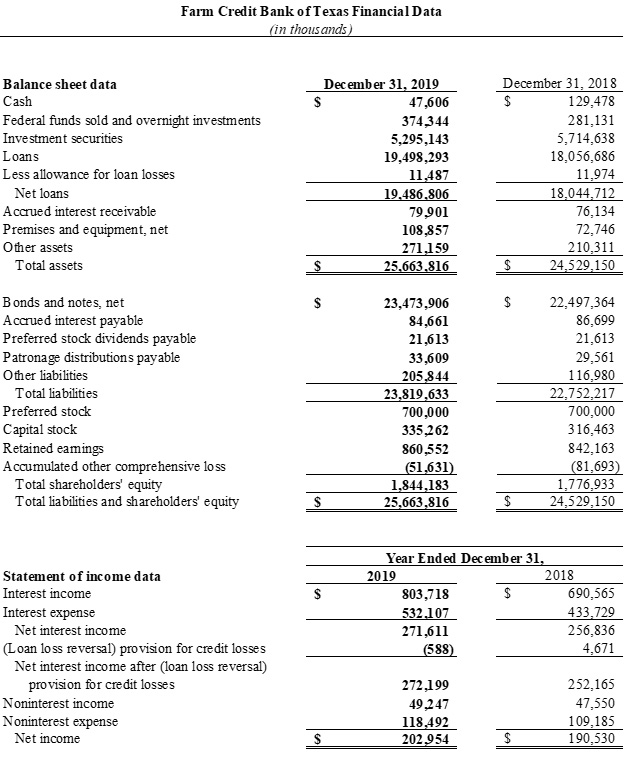

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported a record $203.0 million in net income in 2019. It distributed over 90 percent of its earnings to its stockholders and lending partners in the form of patronage payments and other dividends.

Patronage payments are a way cooperatives distribute earnings to their customers. The cooperatively owned wholesale funding bank provides funding and support services to 14 Farm Credit lending cooperatives and two other financing institutions. It also participates with other lenders in capital markets loans to agribusinesses and rural infrastructure providers.

“We paid a record patronage to our affiliated lenders based on our solid earnings and capital position in 2019,” said Larry Doyle, FCBT chief executive officer. “Patronage effectively lowers their cost of funds. These lenders can then pass the value along to the farmers and ranchers, agribusinesses and other rural customers they finance.”

The bank declared $134.9 million in patronage on its 2019 earnings, compared with $117.4 million on its 2018 earnings. It also distributed $56.5 million in preferred stock dividends.

“The local Farm Credit co-ops in our five-state district experienced strong loan growth in 2019, which helped drive the bank’s loan growth,” Doyle said.

Total assets increased 4.6% in 2019 to a record $25.7 billion. During this same time period, total loan volume increased 8.0% to a record $19.5 billion. Credit quality remained strong, with 99.5% of loans classified as acceptable or special mention.

The bank maintained capital and liquidity well above regulatory requirements. At the end of 2019, it had a total regulatory capital ratio of 16.1% and shareholders’ equity of $1.8 billion. Cash and investments totaled $5.7 billion, providing ample liquidity.

“Farm Credit ensures agriculture and rural communities have access to the dependable credit they need to grow and thrive,” said Jimmy Dodson, FCBT board chair. “The bank’s continued financial strength means ag producers, farm-related businesses and other borrowers in our territory have a funding source they can count on.”

The bank is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. Nationally, the System reported combined net income of $5.4 billion for the year ended Dec. 31, 2019, compared with $5.3 billion a year earlier.

The bank and System results discussed herein are preliminary and unaudited.