Farm Credit Bank of Texas Reports Strong Loan Growth in Second Quarter

For immediate release: August 3, 2018

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a wholesale bank that funds 14 rural Farm Credit lending cooperatives in five states, reported strong loan growth and credit quality in the second quarter of 2018.

The bank’s diversified loan portfolio consists largely of direct notes to Farm Credit cooperatives that lend to farmers, ranchers and other rural borrowers. It also participates with other lenders in loans to agribusinesses, rural infrastructure companies, and other businesses that ag producers and rural communities rely on.

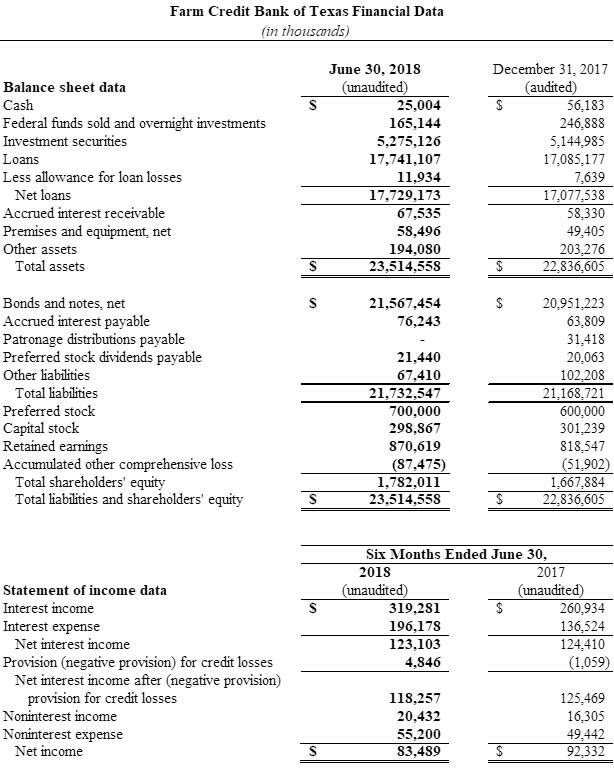

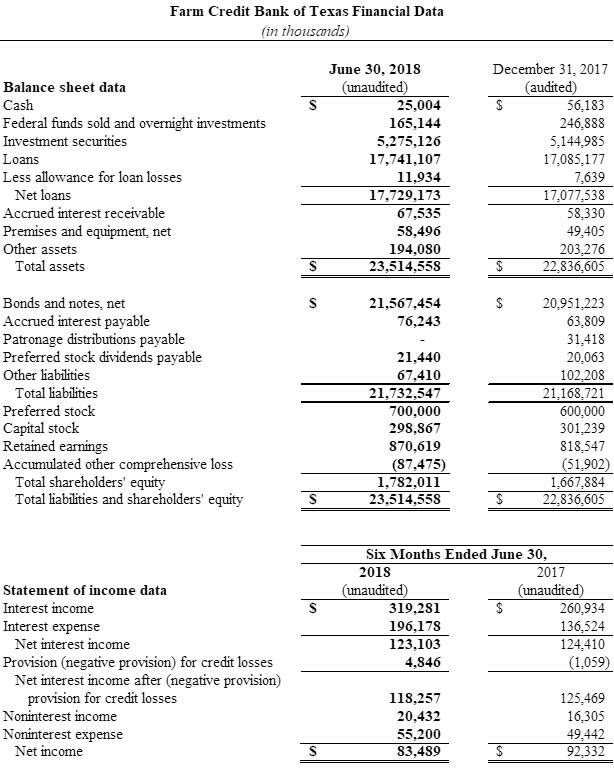

Since year end, total loan volume increased 3.8 percent to $17.7 billion, and total assets increased 3.0 percent to $23.5 billion at June 30, 2018. Credit quality remained very strong, with 99.8 percent of loans considered acceptable or special mention.

The bank reported net interest income of $123.1 million for the six months ended June 30, 2018, a decrease of $1.3 million or 1.1 percent compared with the same period last year. The net interest margin was 1.09 percent for the six months ended June 30, 2018, compared with 1.18 percent for the same period of the prior year. The decline in net interest margin for the six months ended June 30, 2018, was primarily the result of increased debt costs and lower lending spreads on the bank’s capital markets portfolio. The bank also reported net income of $83.5 million for the six months ended June 30, 2018, reflecting a decrease of $8.8 million or 9.6 percent from the same period last year resulting from an increase in provision for credit losses and noninterest expense.

Capital and liquidity continued to exceed the regulatory requirements established by the bank’s federal regulator, the Farm Credit Administration. Cash and high-quality investments totaled $5.5 billion, providing 229 days of liquidity coverage, compared with the regulatory minimum of 120 days.

In June the bank issued $100 million in noncumulative, perpetual preferred stock.

“Our preferred stock issuance was perceived very favorably in the marketplace thanks to the strong financial performance of the bank,” said Larry Doyle, FCBT chief executive officer. “This high-quality, third-party capital supports the bank’s asset growth and positions us to serve agriculture in our five-state territory well into the future.”

The bank is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. Nationally, the System reported combined net income of $1.4 billion and $2.6 billion for the three and six months ended June 30, 2018, compared with $1.2 billion and $2.5 billion a year earlier.