Farm Credit Bank of Texas Reports Record Assets at Midyear

For Immediate Release August 3, 2016

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a cooperatively owned wholesale funding bank that supports agriculture and rural America, reported strong asset growth and credit quality for the second quarter of 2016.

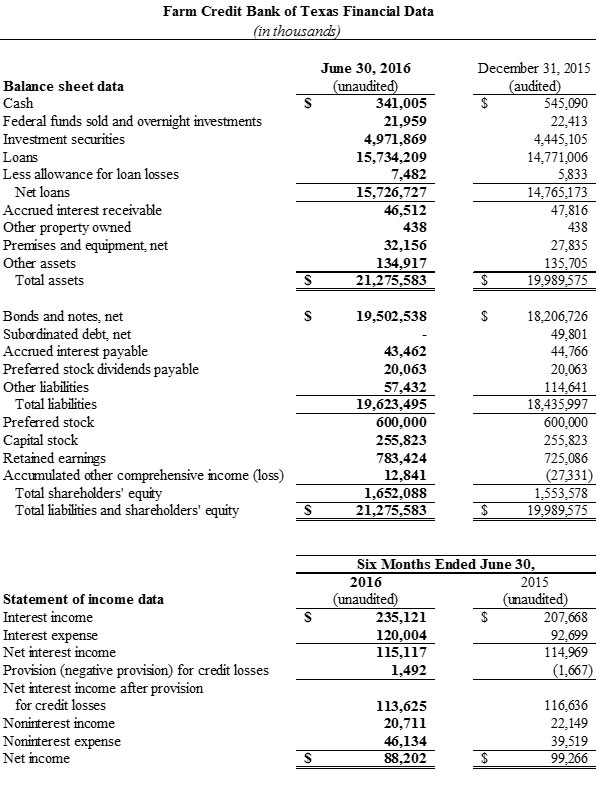

Total assets were a record $21.3 billion at June 30, 2016, reflecting continued growth in the bank’s diversified portfolios of loans and investments. Total loan volume was a record $15.7 billion. Credit quality remained strong, with 99.8 percent of the bank’s loans classified as acceptable or special mention.

Through its direct loan portfolio, the bank funds locally owned Farm Credit lending cooperatives that provide financing and related services to farmers, ranchers and other rural borrowers in a five-state territory. Through its capital markets portfolio, it participates with other lenders in loans to businesses that ag producers and rural communities rely on, such as food processors, agribusinesses and rural infrastructure companies.

“The region that the bank and our affiliated cooperatives serve is home to a vibrant and diverse general economy, which contributed to our solid financial performance,” said Larry Doyle, FCBT chief executive officer.

Despite strong asset growth, net interest income for the three months and six months ended June 30 was similar in 2016 and 2015, reflecting pressure on interest rate spreads and an ongoing low rate environment. The bank took advantage of this environment by calling $4.0 billion in debt since year-end and issuing new debt at lower rates, which increased interest expense in the first and second quarters but will greatly reduce interest expense going forward.

Net income decreased 2.3 percent for the quarter and 11.1 percent for the six months ended June 30, 2016, compared with the same periods in the prior year, when the bank benefited from a nonrecurring gain on the sale of acquired property and a reversal of allowance for loan loss. This year’s results mark a return to more normalized earnings, as well as increased operating expense.

The bank maintained strong capital and liquidity levels, exceeding regulatory requirements set by its federal regulator, the Farm Credit Administration. At June 30, 2016, the bank had $1.7 billion in shareholders’ equity and a permanent capital ratio of 17.1 percent. Cash and investments totaled $5.3 billion, providing 182 days of liquidity.

Together, the bank and 14 affiliated cooperatives across Alabama, Louisiana, Mississippi, New Mexico and Texas constitute the Texas Farm Credit District. Conditions in the district in the second quarter were generally favorable for agricultural producers. Above-average rainfall and cooler temperatures that prevailed until May resulted in good crop progress and less-than-average drought for the season. Despite continued low commodity prices, declining costs for major inputs such as fertilizer and chemicals helped crop producers remain profitable. Livestock producers took advantage of lower feed prices, and efficient cattle producers benefited from profitability across the supply chain, including cow-calf, feedlot and packer operations. Overall, rural land values and demand remained stable.

“Farm Credit’s unwavering commitment to supporting agriculture and rural communities has allowed our cooperatives to be successful for a century — a milestone that we reached this summer,” said FCBT Board Chairman Jimmy Dodson. “The bank’s positive results and cooperative business model give us the capacity to successfully carry out our mission into the next 100 years.”

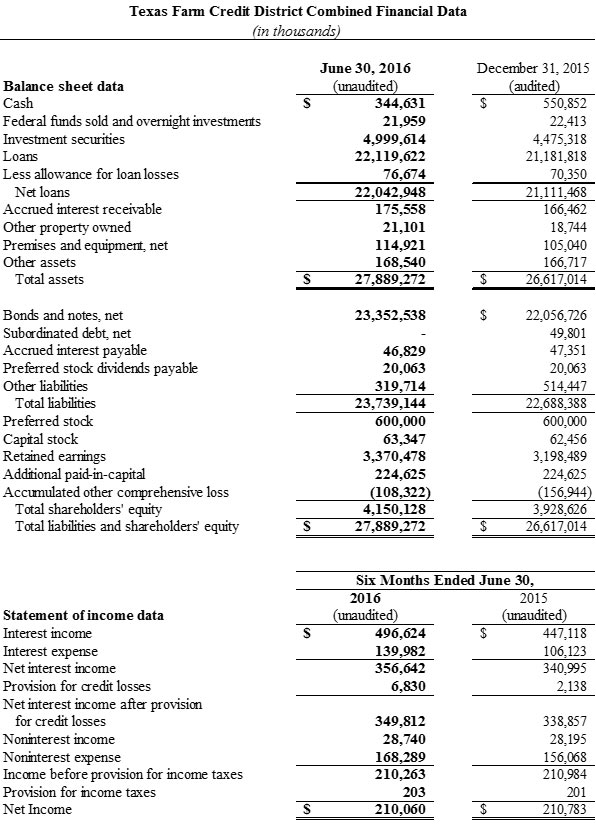

Collectively, the district institutions reported record loan volume and total assets at June 30, 2016. Credit quality remained strong, with 98.7 percent of district loans classified as acceptable or special mentions.

The district’s combined net income in the second quarter increased 6.7 percent compared with the same period of the prior year. Net income for the first six months of 2016 was nearly unchanged year over year.

The district is part of the Farm Credit System, a nationwide network of cooperatives established in July 1916. Nationally, the System reported combined net income of $1.18 billion and $2.34 billion for the three-month and six-month periods ended June 30, 2016, compared with $1.14 billion and $2.27 billion for the same periods in 2015.

The bank, district and System results discussed herein are preliminary and unaudited. The bank’s financial statements and the combined statements of the Texas District for the quarter ended June 30, 2016, are expected to be available on or about Aug. 9, 2016.