Farm Credit Bank of Texas reports midyear 2024 financial results

FOR IMMEDIATE RELEASE August 2, 2024

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported solid earnings, loan growth and continued strong credit quality in the second quarter and first half of 2024.

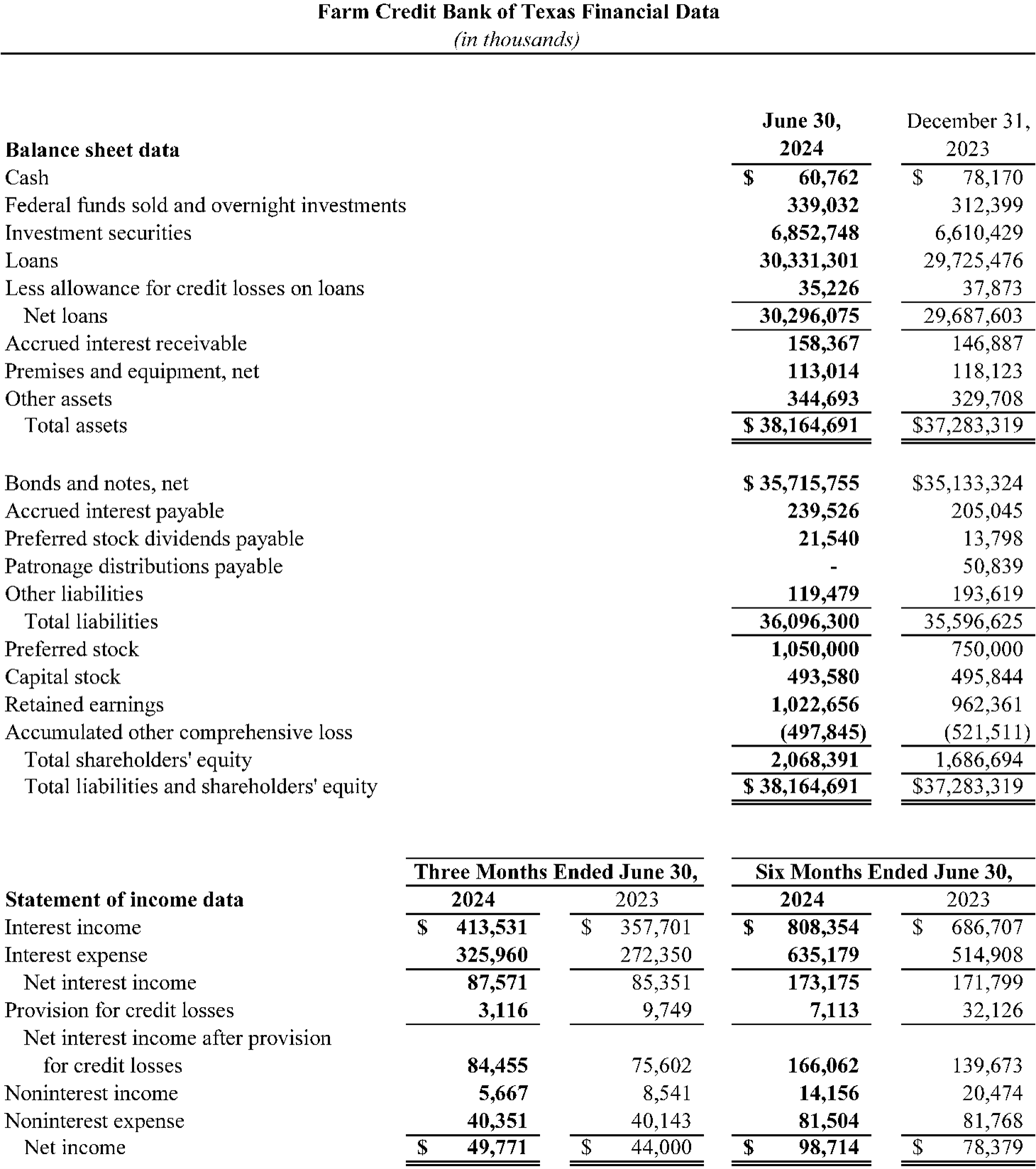

Net income totaled $49.8 million and $98.7 million for the three months and six months ended June 30, 2024, up 13.1% and 25.9% compared with the same periods of 2023. The increases in both periods were driven primarily by lower provisions for credit losses on loans and higher net interest income, partially offset by lower noninterest income. The decrease in noninterest income reflects losses on the sales of loans within the bank’s participations portfolio, partially offset by a refund from the Farm Credit System Insurance Corporation in April 2024.

Net interest income was $87.6 million for the quarter and $173.2 million year to date, up 2.6% and 0.8% compared with the same periods of 2023. The increases reflect growth in the bank’s average earning assets, partially offset by decreases in the net interest spread due to a continued challenging interest rate environment and elevated funding costs.

The bank recorded a $3.1 million provision for credit losses for the second quarter, due primarily to specific reserves and related charge-offs for certain agribusiness loans, partially offset by the reversal of specific reserves for an agribusiness loan that was moved to other property owned. It recorded a $7.1 million provision for credit losses year to date, due primarily to specific reserves and related charge-offs for certain agribusiness loans, as well as an increase in general reserves due to higher qualitative reserves and elevated economic scenario risk.

In addition, the bank issued $300.0 million of Class B perpetual noncumulative subordinated preferred stock in May. Preferred stock totaled $1.05 billion at June 30, 2024, including the Class B series issued in 2013, 2018 and 2020.

“The bank’s financial and credit performance through this year has been strong,” said Amie Pala, FCBT chief executive officer. “However, persistent inflation and high interest rates still present headwinds for agricultural lenders and borrowers. Our recent preferred stock issuance, along with other capital management strategies, further strengthens our capital position and increases our capacity to support continued loan growth and manage risk through this business cycle.”

Total loan volume increased 2.0% from year-end 2023 to $30.3 billion at June 30, 2024. The increase reflected growth in the bank’s direct notes to its affiliated retail lenders, which finance agriculture, rural real estate and agribusiness. Total assets increased 2.4% to $38.2 billion, reflecting growth in loans and investments. Nonperforming assets, which consisted of nonaccrual loans, accruing loans 90 days or more past due and other property owned, remained low at 0.18% of total loans, compared with 0.14% at year-end. Overall credit quality remained strong, with 99.5% of loans classified as acceptable or special mention.

Agricultural conditions were generally favorable across the bank’s five-state district, and precipitation continued to bring adequate moisture to most of the territory. Although agricultural producers and processors may face a variety of risk factors in 2024, the district’s loan portfolio is well supported by industry diversification and conservative advance rates.

“The bank and its affiliated lending cooperatives are serving their mission by helping rural communities and agriculture thrive in this economic environment,” said Jimmy Dodson, FCBT board chair. “Loan growth and favorable credit quality illustrate the resilience and fortitude of Farm Credit borrowers as we look forward to a productive agricultural year.”

At the end of the second quarter, the bank had $2.1 billion in shareholders’ equity and a total capital ratio of 14.22%. The 22.6% increase in shareholders’ equity since year-end was driven primarily by the issuance of preferred stock. Cash and investments totaled $7.3 billion, providing ample liquidity and exceeding regulatory requirements.

The bank is part of the Farm Credit System , a nationwide network of cooperatives established in 1916. The System reported combined net income of $1.9 billion and $3.9 billion for the three months and six months ended June 30, 2024, compared with $1.8 billion and $3.5 billion for the same periods of the prior year.

These financial results are preliminary and unaudited. The bank will post its 2024 second-quarter financial report at farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 13 local lending cooperatives and two other financing institutions in Alabama, Louisiana, New Mexico, Mississippi and Texas. These lenders make loans to farmers, ranchers, agribusinesses and rural property owners. The bank also partners with other lenders to finance agricultural production and processing, essential rural infrastructure and more.