Farm Credit Bank of Texas Reports 2024 Year-end Financial Results

FOR IMMEDIATE RELEASE February 25, 2025

AUSTIN, Texas – February 25, 2025 – Farm Credit Bank of Texas (FCBT) reported solid earnings and loan growth, while sustaining strong credit quality in 2024.

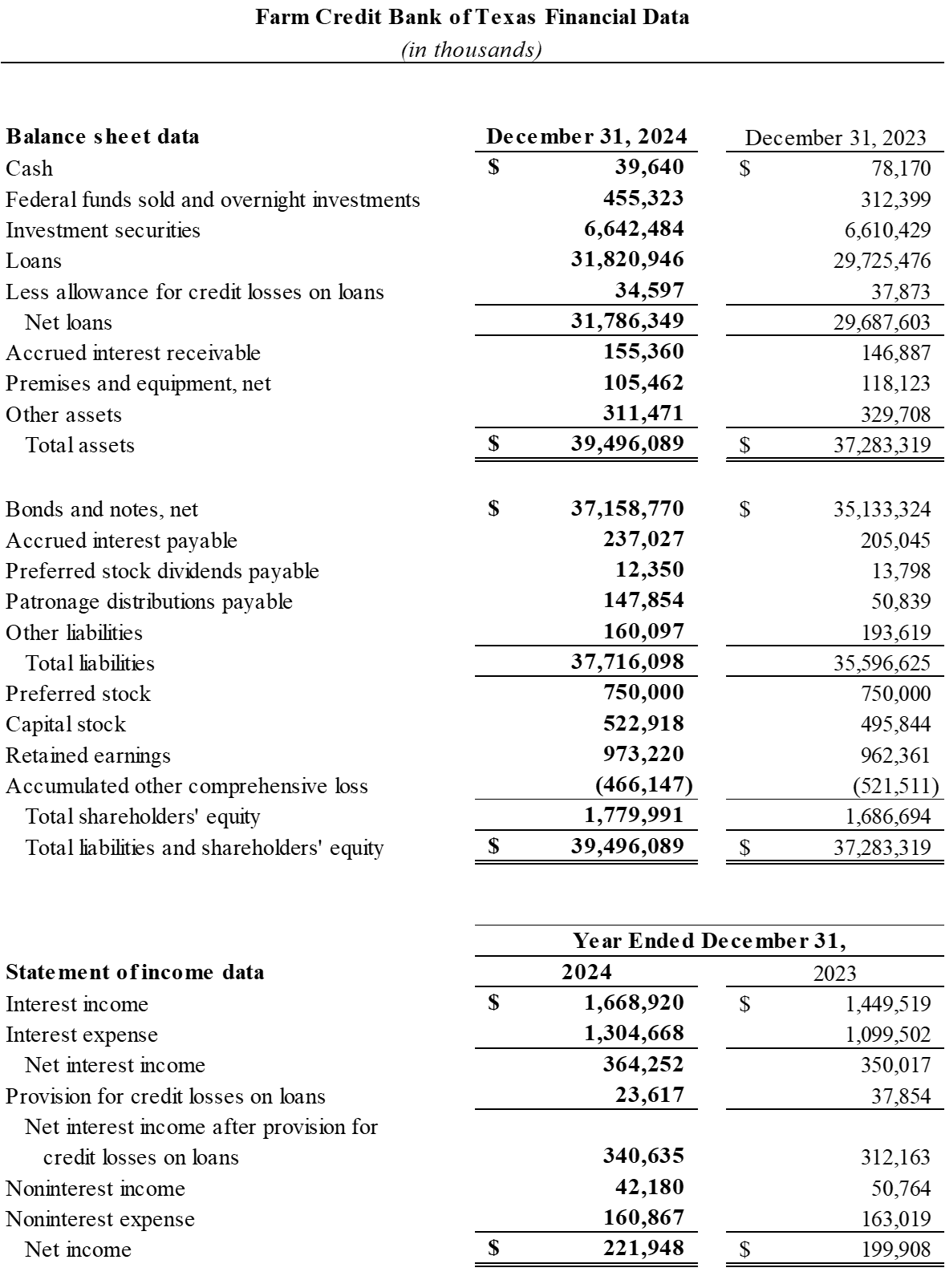

Total loan volume increased 7.0% in 2024 to $31.8 billion at Dec. 31, primarily reflecting growth in direct notes to the bank’s affiliated lending institutions. Total assets increased 5.9% to $39.5 billion. Overall credit quality remained high, with 99.6% of loans classified as acceptable or special mention, compared with 99.5% at year-end 2023.

“The bank navigated a volatile interest rate environment in 2024, managing economic headwinds while remaining committed to financial stability and growth,” said Amie Pala, FCBT chief executive officer. “We are well-positioned for continued growth, remaining committed to supporting rural America and strengthening the communities we serve through strategic investments in talent, innovation, and operational excellence.”

Net interest income for the year ending Dec. 31, 2024, totaled $364.3 million, an increase of $14.2 million or 4.1% year over year. The growth in net interest income for 2024 was mainly driven by a $1.26 billion increase in average interest-earning assets, along with the income generated from assets funded by non-interest-bearing sources. This was partially offset by a four-basis point decline in the interest rate spread.

The bank recognized a $23.6 million provision for credit losses on loans for 2024, compared with $37.9 million for 2023. The provision for 2024 reflects specific reserves associated with credit deterioration for a limited number of borrowers in the agribusiness and production and intermediate-term sectors that were impacted by the challenging economic environment. Nonperforming assets, which consist of nonaccrual loans, accruing loans 90 days or more past due and other property owned, remained low at 0.15% of total loans and other property owned, compared with 0.14% at year-end 2023.

Net income for 2024 was $221.9 million, an 11.0% increase year over year due to the conditions described above. As a cooperative, the bank distributes earnings to its member-owners and lending partners through patronage programs. It declared $155.0 million in patronage based on 2024 earnings.

“The board acts annually to approve its patronage programs to its affiliated lending partners,” said Jimmy Dodson, FCBT board chair. “This process helps reduce funding costs, allowing our partners to pass those savings on to their members to better support agriculture and rural communities.”

At the end of 2024, the bank had $1.8 billion in shareholders’ equity and a total capital ratio of 13.3%. Cash and high-quality liquid investments totaled $7.1 billion, significantly exceeding regulatory requirements.

The bank is part of the Farm Credit System, a nationwide network of customer-owned financial institutions established in 1916. The System reported combined net income of $7.8 billion for the year ending Dec. 31, 2024, compared with $7.4 billion the prior year.

These financial results are preliminary and unaudited. The bank will post its 2024 annual report at http://www.farmcreditbank.com/financials/bank-financial-reports .

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America within the Texas Farm Credit District. It funds 12 affiliated associations and two other financing institutions, enabling them to make loans to farmers, ranchers, agribusinesses, and rural property owners. It also partners with other lenders to finance agricultural production and processing, essential rural infrastructure and more. The bank is part of the Farm Credit System , the nation’s oldest and largest source of rural financing.