Farm Credit Bank of Texas Distributes Majority of 2017 Earnings to Stockholders

For immediate release: February 22, 2018

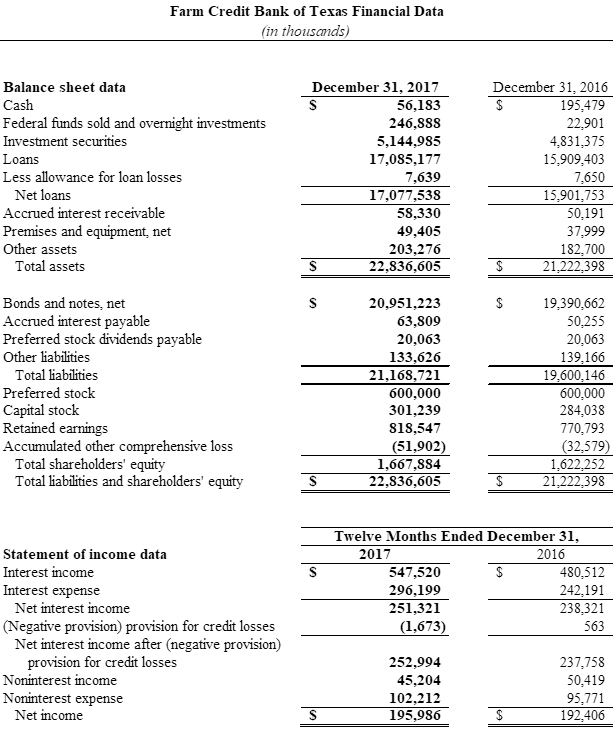

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a wholesale funding bank and part of the nationwide Farm Credit System, reported $196.0 million in net income in 2017, its 12th consecutive year of record earnings.

The bank is a customer-owned cooperative and returns the majority of its earnings to its patrons. Based on the solid earnings and capital position, the bank’s board of directors approved the return of $154.2 million in patronage and other dividends, or 78.7 percent of 2017 earnings, to the bank’s affiliated lenders and other patrons.

“Patronage is a unique benefit of doing business with a cooperative,” said Larry Doyle, FCBT chief executive officer. “As a result, the lending institutions that we fund pay no more for funding than the bank pays, and can pass that value along to farmers, ranchers, agribusinesses and other local customers.”

Total assets increased 7.6 percent in 2017 to a record $22.8 billion. Total loan volume — which includes a capital markets portfolio and direct notes to 14 lending cooperatives and three other financing institutions in five states — was a record $17.1 billion at year-end, with 99.7 percent of loans considered acceptable or special mention.

Capital and liquidity remained strong, providing opportunity for growth and protection from adversity. The bank finished the year with a total capital ratio of 16.6 percent and shareholders’ equity of $1.7 billion. Cash and investments totaled $5.4 billion, providing 227 days of liquidity.

“The bank’s excellent financial results benefited from the strong economy and positive agricultural conditions in our five-state territory,” said FCBT Board Chairman Jimmy Dodson. “Our earnings have a direct impact on retail borrowers. We’re investing in the future by providing innovative new technology to our affiliated Farm Credit lenders so they can provide a smooth experience for their customers.”

The Farm Credit System is a nationwide network of cooperatives that was established in 1916. Nationally, the System reported combined net income of $5.2 billion for the year ended Dec. 31, 2017, compared with $4.8 billion a year earlier.

The bank and System results discussed herein are preliminary and unaudited.