Farm Credit Bank of Texas distributes 93% of record 2021 earnings

FOR IMMEDIATE RELEASE February 23, 2022

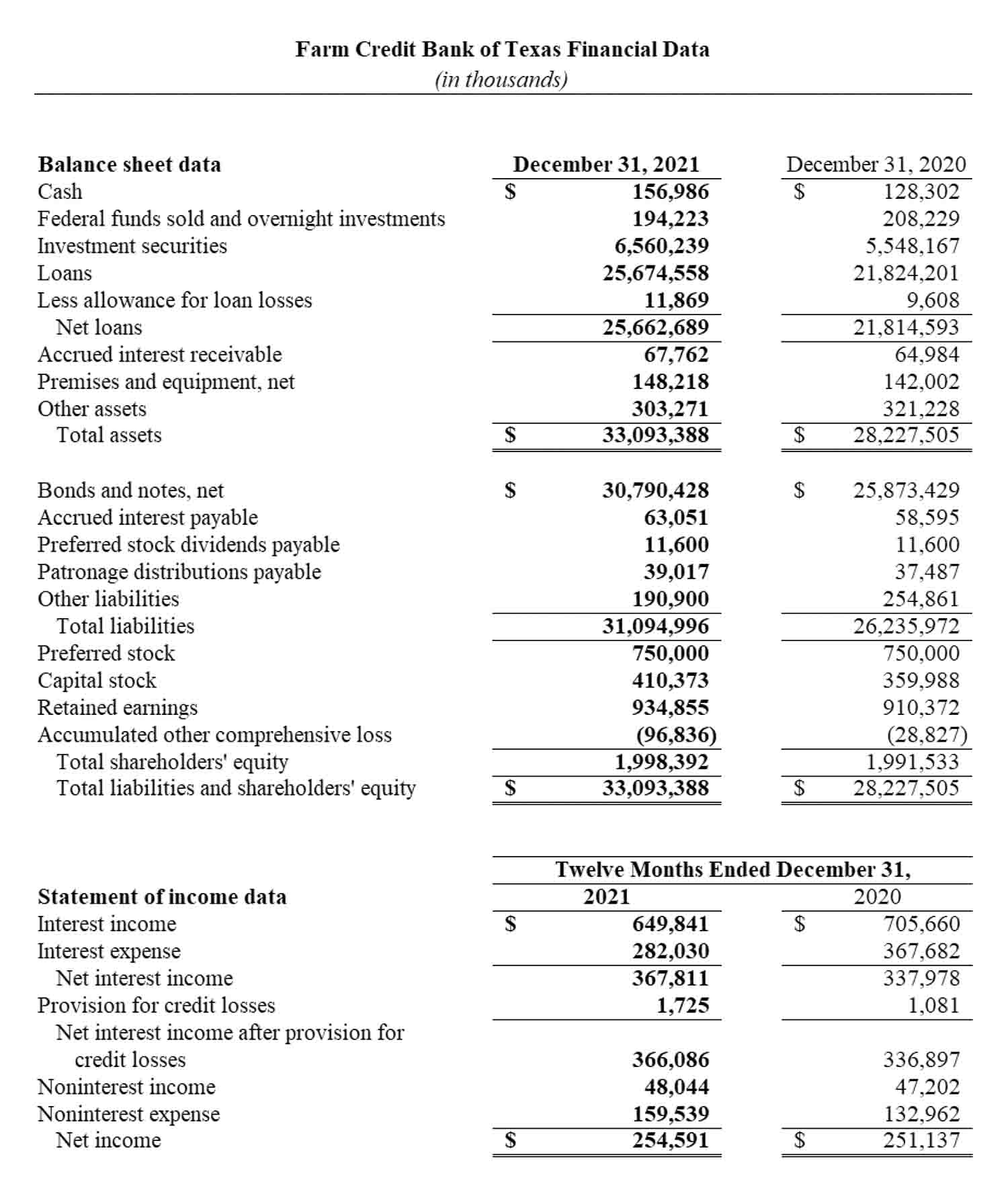

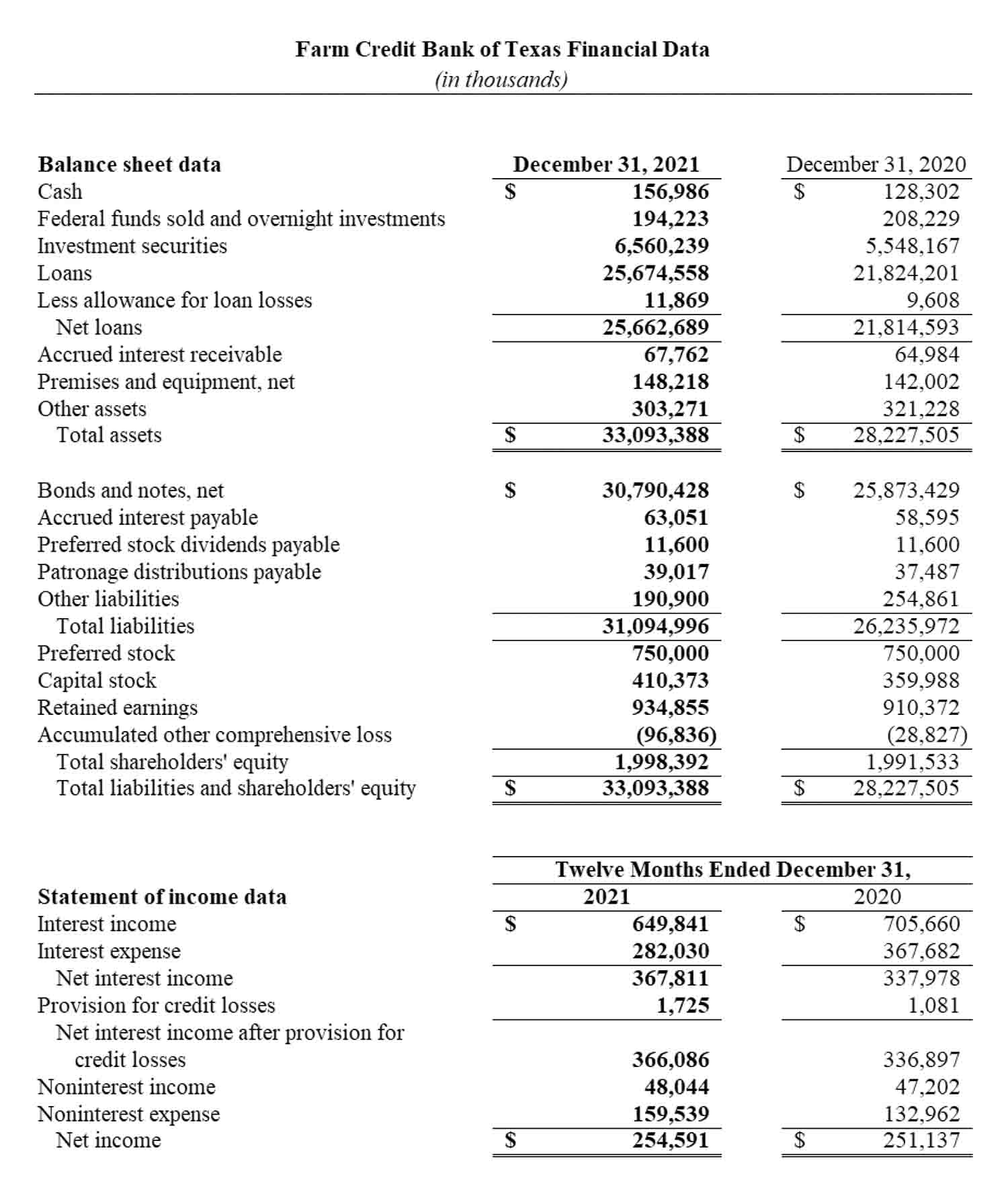

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a cooperatively owned funding bank, reported a record $254.6 million in net income in 2021. It distributed 93% of its earnings in the form of patronage payments and other dividends.

The bank provides funding and support services to 14 Farm Credit lending cooperatives that own the bank — also called associations — and two other financing institutions. It also participates with other lenders in loans to agribusinesses and rural infrastructure providers.

As a cooperative, the bank distributes earnings to its member-owners and lending partners through several patronage programs. The bank declared a record $190.4 million in patronage based on its solid earnings and capital position in 2021. It also paid $46.4 million in preferred stock dividends.

“Patronage is a tangible benefit of our cooperative business model,” said Amie Pala, FCBT chief executive officer. “It reduces funding costs significantly for our affiliated lenders, who pass the value on to their local borrowers. Ultimately, our strong financial health benefits the agricultural producers and rural communities we have a mission to serve.”

Asset growth surpassed projections as low interest rates and strong economic conditions fueled loan demand across the bank’s five-state territory. Its district includes Alabama, Louisiana, Mississippi, New Mexico and Texas.

In 2021, the bank’s total loan volume increased 17.6% to $25.7 billion. Total assets increased 17.6% to $33.1 billion. Credit quality remained high, with 99.8% of loans classified as acceptable or special mention.

At the end of 2021, the bank had $2.0 billion in shareholders’ equity and a total capital ratio of 15.17%. Cash and investments totaled $6.9 billion, exceeding regulatory requirements and providing ample liquidity.

“While the bank experienced growth across its diversified portfolios in 2021, its direct notes to associations and other affiliated lenders grew 21.8%,” said Jimmy Dodson, FCBT board chair. “The bank is focused on helping these retail lenders streamline loan processing and offer services to meet the needs of their customers — farmers, ranchers, agribusinesses and rural property owners.”

The bank is part of the Farm Credit System, a nationwide network of agricultural and rural financing cooperatives established in 1916. The System reported combined net income of $6.8 billion for the year ended Dec. 31, 2021, compared with $6.0 billion the prior year.

These financial results are preliminary and unaudited. The bank will post its 2021 annual report at www.farmcreditbank.com/financials/bank-financial-reports.