Farm Credit Bank of Texas Distributes 90 Percent of 2018 Earnings to Stockholders

For immediate release: February 22, 2019

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a wholesale funding bank and part of the nationwide Farm Credit System, has returned 90 percent of its net income from 2018 to its affiliated lenders and other stockholders.

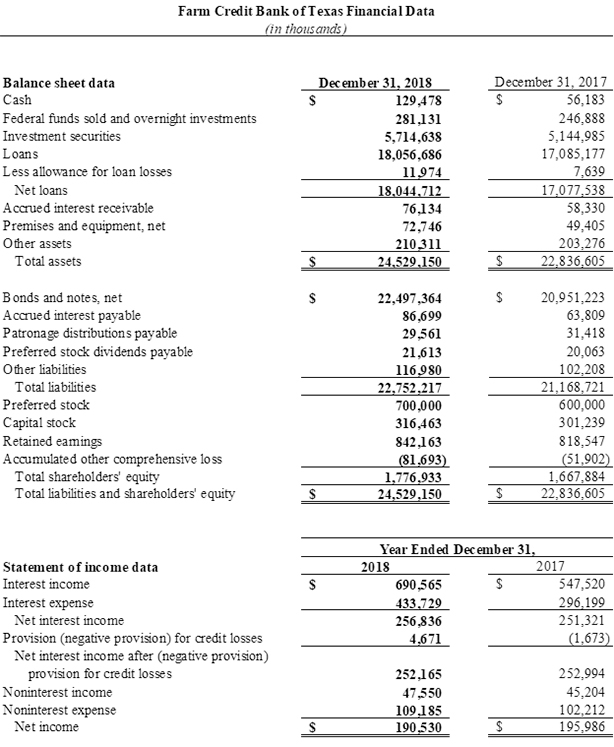

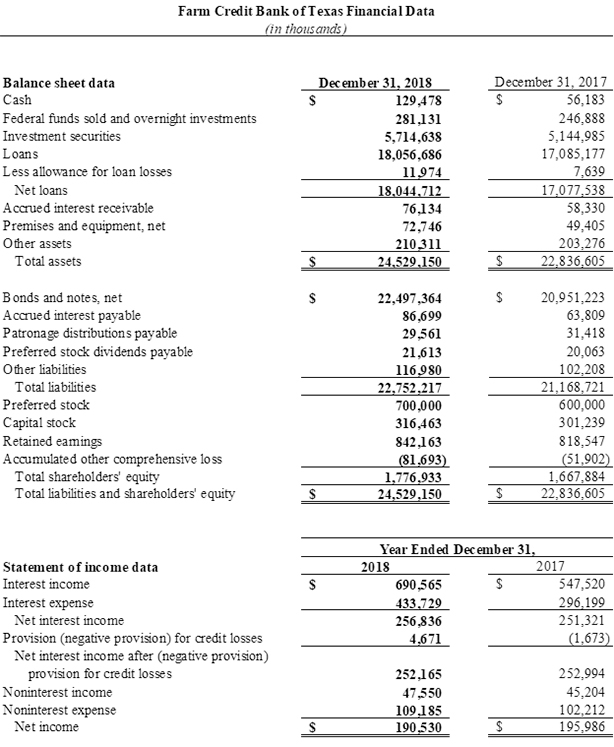

Based on its $190.5 million in net income and its solid capital position in 2018, the Austin-based bank declared a record $117.4 million in patronage and distributed another $54.7 million in preferred stock dividends.

Patronage is a key benefit of doing business with cooperatives, which are owned by their customers. By distributing earnings to its affiliated lending co-ops and other lending institutions, the bank lowers their funding costs. In turn, these lenders pass the value along to their own customers — farmers, ranchers, rural homeowners, agribusinesses and other local borrowers.

“We provide funding and support services that these member-owned lending institutions need to serve their borrowers,” said Larry Doyle, FCBT chief executive officer. “Distributing patronage and absorbing the cost of the tools and technology we provide are some of the ways we keep funding affordable for our affiliated lenders and their borrowers.”

The bank supports agriculture and rural communities by providing access to consistent credit. Total loan volume — which includes a capital markets participations portfolio and direct notes to 14 lending cooperatives and two other financing institutions in five states — was a record $18.1 billion at the end of 2018. Total assets increased 7.4 percent in 2018 to a record $24.5 billion. Credit quality remained very strong, with 99.6 percent of loans considered acceptable or special mention.

“Farm Credit Bank of Texas finished 2018 in excellent financial health,” said Jimmy Dodson, FCBT board chairman. “Not only have we returned most of our earnings to our affiliated lenders, but we also are investing in market-fresh technology for them and their borrowers. These new tools will bring the financial industry’s newest innovations to rural communities across our territory.”

At the end of 2018, the bank had a total capital ratio of 16.4 percent and shareholders’ equity of $1.8 billion. Cash and investments totaled $6.1 billion, providing 241 days of liquidity, which exceeds the regulatory requirement of 120 days.

The Farm Credit System is a nationwide network of cooperatives that was established in 1916. Nationally, the System reported combined net income of $5.3 billion for the year ended Dec. 31, 2018, compared with $5.2 billion a year earlier.

The bank and System results discussed herein are preliminary and unaudited.