Farm Credit Bank of Texas reports 2023 year-end financial results

FOR IMMEDIATE RELEASE February 27, 2024

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported earnings, solid loan growth and strong credit quality in 2023.

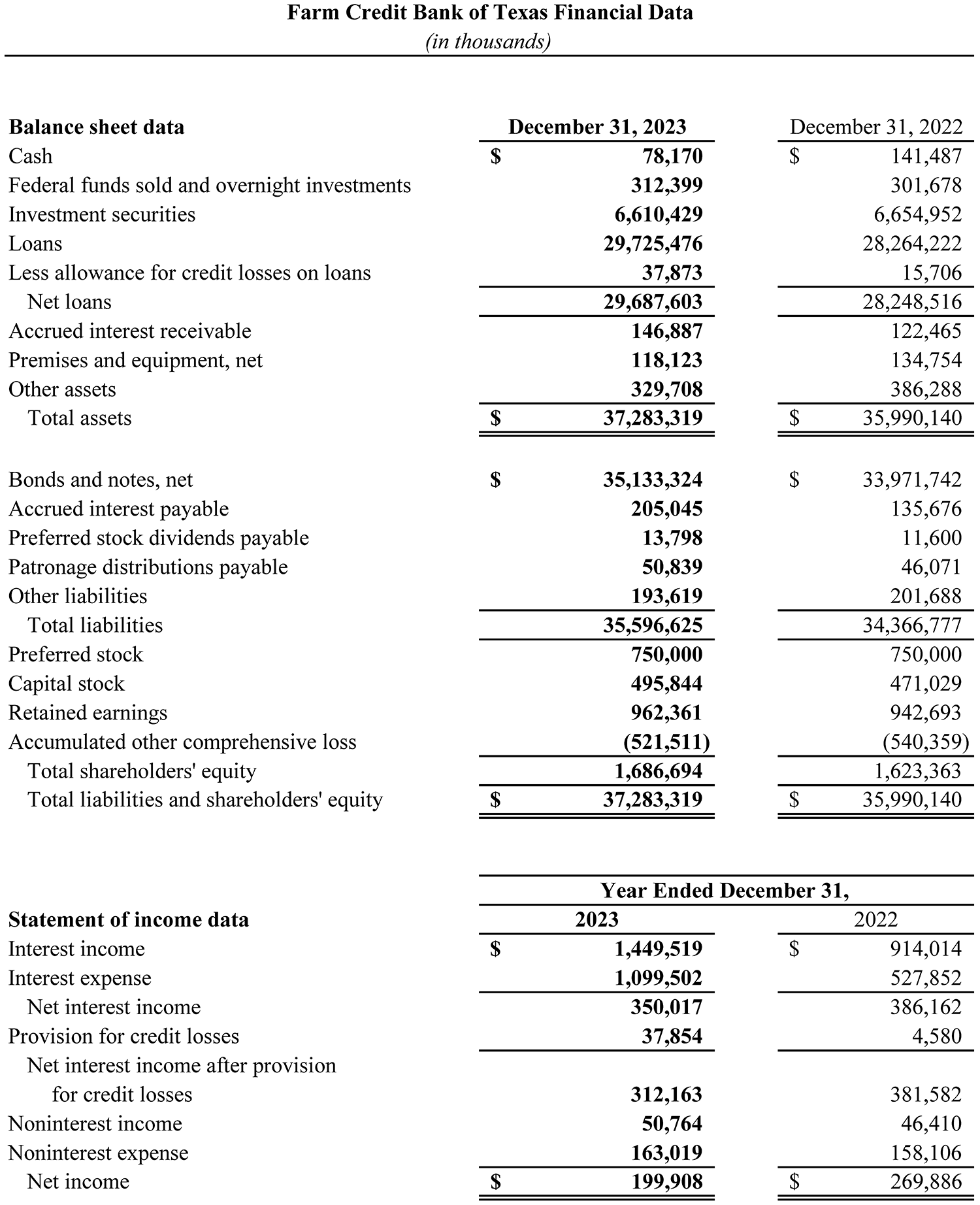

Total loan volume increased 5.2% in 2023 to $29.7 billion at Dec. 31, primarily reflecting growth in direct notes to the bank’s affiliated lending institutions. Total assets increased 3.6% to $37.3 billion. Overall credit quality remained high, with 99.5% of loans classified as acceptable or special mention, compared with 99.7% at year-end 2022.

“The Federal Reserve has increased interest rates at a historically fast pace to fight persistent inflation, which resulted in higher funding costs for the bank, and higher input costs and interest rates for agricultural borrowers,” said Amie Pala, FCBT chief executive officer. “These factors resulted in lower bank earnings in 2023. However, the bank’s overall strong financial position during a challenging economic environment demonstrated our resiliency. We remain a source of dependable funding and support services to our affiliated lenders who serve the rural marketplace.”

Net interest income for the year ending Dec. 31, 2023, totaled $350.0 million, a decrease of $36.1 million or 9.4% year over year. The change reflects a decrease of 21 basis points in interest rate spread due to the volatile interest rate environment. This was partially offset by a $1.9 billion increase in the bank’s average earning assets.

The bank recognized a $37.9 million provision for credit losses on loans for 2023, compared with $4.6 million for 2022. The change primarily reflected higher specific reserves associated with a limited number of borrowers in the agribusiness, energy, and production and intermediate-term sectors that were impacted by the economic environment. The bank also increased its general reserves $8.4 million. Nonperforming assets, which consist of nonaccrual loans, remained low at 0.14% of total loans, compared with 0.11% at year-end 2022.

Net income for 2023 was $199.9 million, a 25.9% decrease year over year due to the conditions described above. As a cooperative, the bank distributes earnings to its member-owners and lending partners through patronage programs. It declared $148.8 million in patronage based on 2023 earnings.

“In keeping with our strong commitment to cooperative principles, each year our board of directors determines how much of the bank’s net income to return in the form of patronage dividends,” said Jimmy Dodson, FCBT board chair. “These cooperative returns reduce funding costs for our affiliated lending institutions, which in turn can pass the value along to benefit their borrowers in agriculture and rural communities.”

At the end of 2023, the bank had $1.7 billion in shareholders’ equity and a total capital ratio of 13.4%. Cash and high-quality liquid investments totaled $7.0 billion, significantly exceeding regulatory requirements.

The bank is part of the Farm Credit System, a nationwide network of customer-owned financial institutions established in 1916. The System reported combined net income of $7.4 billion for the year ending Dec. 31, 2023, compared with $7.3 billion the prior year.

These financial results are preliminary and unaudited. The bank will post its 2023 annual report at www.farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 13 local lending cooperatives and two other financing institutions in Alabama, Louisiana, New Mexico, Mississippi and Texas. These lenders make loans to farmers, ranchers, aquatic producers, agribusinesses and rural property owners. The bank also participates with other lenders in capital markets loans to agribusinesses and rural infrastructure providers.