Farm Credit Bank of Texas reports year-end financial results

FOR IMMEDIATE RELEASE February 22, 2023

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported solid earnings, loan growth and credit quality in 2022.

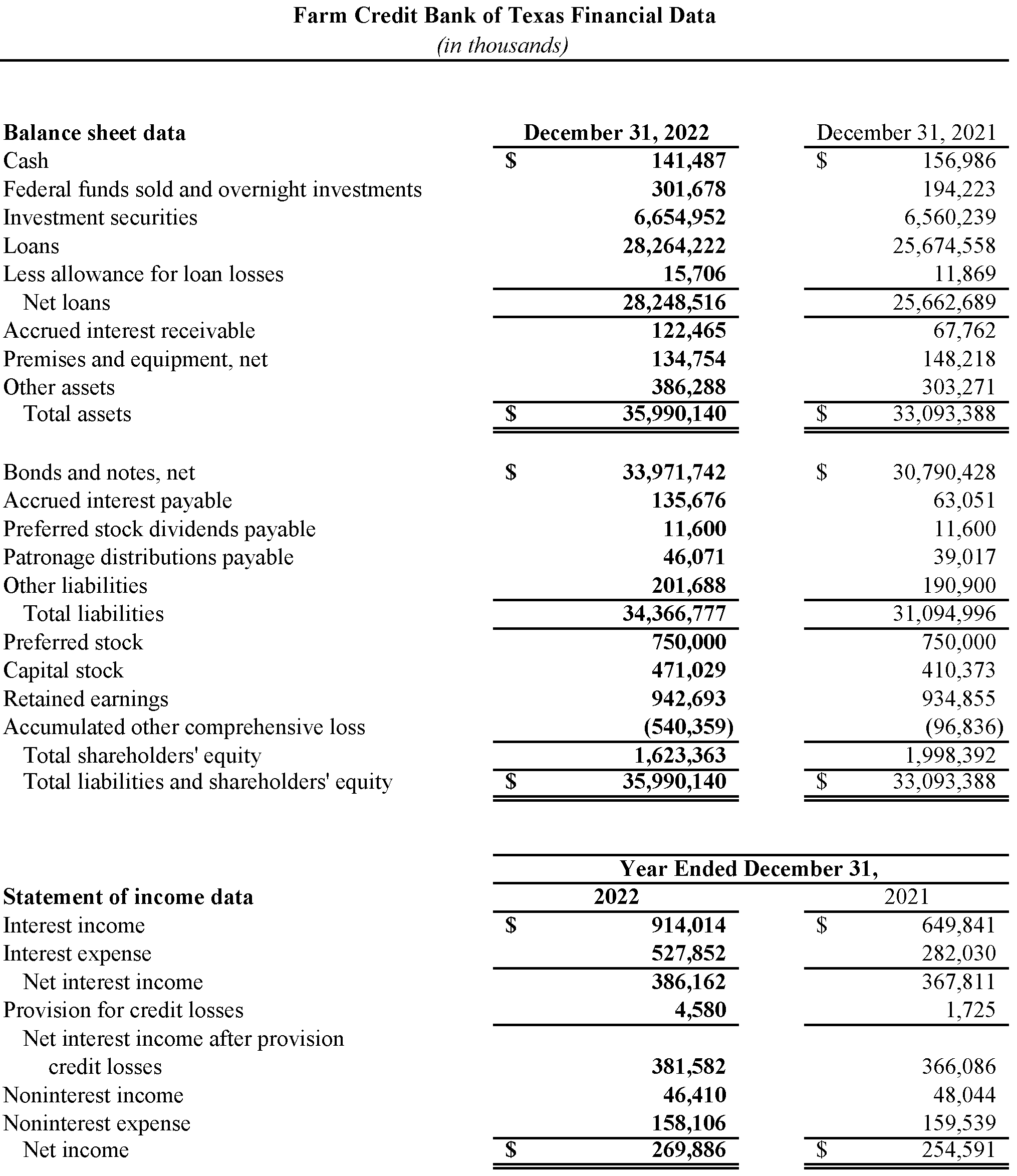

Net income for the year ending Dec. 31, 2022, totaled $269.9 million, an increase of 6.0% year over year. Net interest income totaled $386.2 million, an increase of 5.0% year over year. Net interest income benefited from a $4.8 billion increase in average earning assets in 2022, which reflects growth in the bank’s loan and investment portfolios. This was partially offset by a 13 basis point decrease in interest rate spread due to the rising interest rate environment and inverted yield curve.

As a cooperative, the bank distributes earnings to its member-owners and lending partners through several patronage programs. It declared a record $223.2 million in patronage based on 2022 earnings.

“Patronage payments reduce borrowing costs and are especially beneficial given the economic environment,” said Amie Pala, FCBT chief executive officer. “Our cooperative business model helps our affiliated lenders provide competitive financing for rural communities and agriculture.”

Total assets increased 8.8% in 2022 to a record $36.0 billion at Dec. 31. Total loan volume grew 10.1% to $28.3 billion, reflecting increases of 6.7% in direct notes to the bank’s affiliated lenders and 18.4% in loan participations. Credit quality remained high, with 99.7% of loans classified as acceptable or special mention.

“High commodity prices and production expenses in 2022 required many farmers and ranchers, agribusinesses, food processors and other borrowers to seek new or additional financing,” said Jimmy Dodson, FCBT board chair. “Farm Credit has a mission to provide reliable, consistent credit and financial services.”

At the end of 2022, the bank had $1.6 billion in shareholders’ equity and a total capital ratio of 13.5%. Cash and investments totaled $7.1 billion, exceeding regulatory requirements and providing ample liquidity.

The bank is part of the Farm Credit System, a nationwide network of customer-owned financial institutions established in 1916. The System reported combined net income of $7.3 billion for the year ending Dec. 31, 2022, compared with $6.8 billion the prior year.

These financial results are preliminary and unaudited. The bank will post its 2022 annual report at www.farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 14 local lending cooperatives and two other financing institutions in Alabama, Louisiana, New Mexico, Mississippi and Texas. These lenders make loans to farmers, ranchers, agribusinesses and rural property owners. The bank also participates with other lenders in capital markets loans to agribusinesses and rural infrastructure providers.