Farm Credit Bank of Texas Reports Third Quarter Financial Results

For Immediate Release November 1, 2019

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported growth in earnings, loans and assets in the first nine months of 2019.

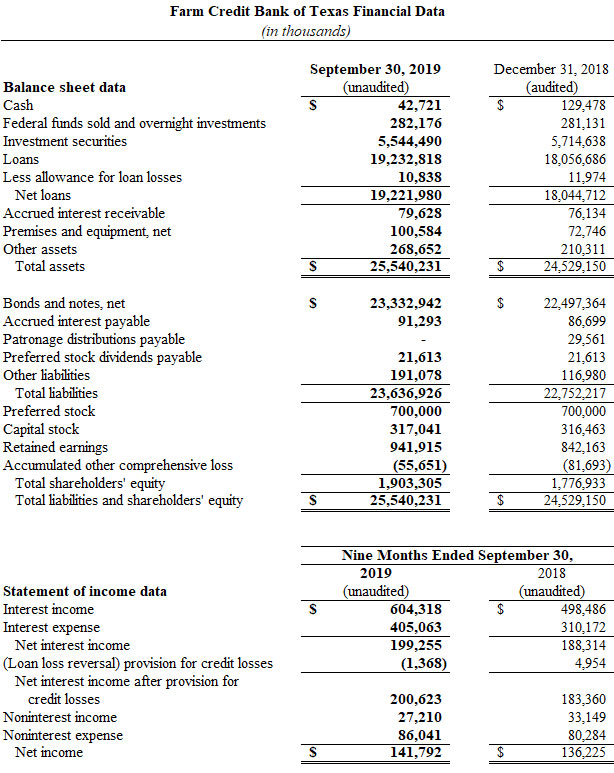

Net income totaled $46.6 million and $141.8 million for the three months and nine months ended Sept. 30, 2019. By comparison, the bank reported $52.7 million and $136.2 million in net income for same periods of 2018. The key drivers for the higher year-to-date earnings were an increase in net interest income and a decrease in provision for credit losses. The bank offset lower spreads during a challenging interest rate environment by growing its assets and positioning its debt portfolio to take advantage of movements in rates.

“The strong economy in our five-state territory is fueling loan demand and credit quality,” said Larry Doyle, FCBT chief executive officer. “Our diversified loan portfolio continues to grow.”

Total loans increased 6.5% since the end of 2018 to $19.2 billion at Sept. 30, 2019. Total assets increased 4.1% since year-end to $25.5 billion. Credit quality remained strong, with 99.5% of loans classified as acceptable or special mention.

The cooperatively owned wholesale funding bank provides funding and support services to 14 Farm Credit lending cooperatives and two other financing institutions. Those lenders, in turn, provide credit and financial services to farmers, ranchers, agribusinesses, rural homeowners and landowners. The bank also participates with other lenders in capital markets loans to agribusinesses and rural infrastructure providers.

“The bank provides funding that’s essential for agriculture and rural communities to succeed,” said FCBT Board Chairman Jimmy Dodson. “Access to dependable credit and financial services helps ag producers in our territory remain resilient.”

Shareholders’ equity totaled $1.9 billion at the end of the third quarter. Cash and investments totaled $5.9 billion, providing 227 days of liquidity.

The bank is part of the Farm Credit System, a nationwide network of rural lending cooperatives established in 1916. Nationally, the System reported combined net income of $1.4 billion and $4.1 billion for the three and nine months ended Sept. 30, 2019, compared with $1.4 billion and $4.0 billion a year earlier.

The financial results discussed herein are preliminary and unaudited. The bank will post its quarterly financial report at www.farmcreditbank.com/financials/bank-financial-reports.