Farm Credit Bank of Texas reports first quarter 2022 financial results

FOR IMMEDIATE RELEASE May 3, 2022

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported strong loan growth, earnings and credit quality in the first quarter of 2022.

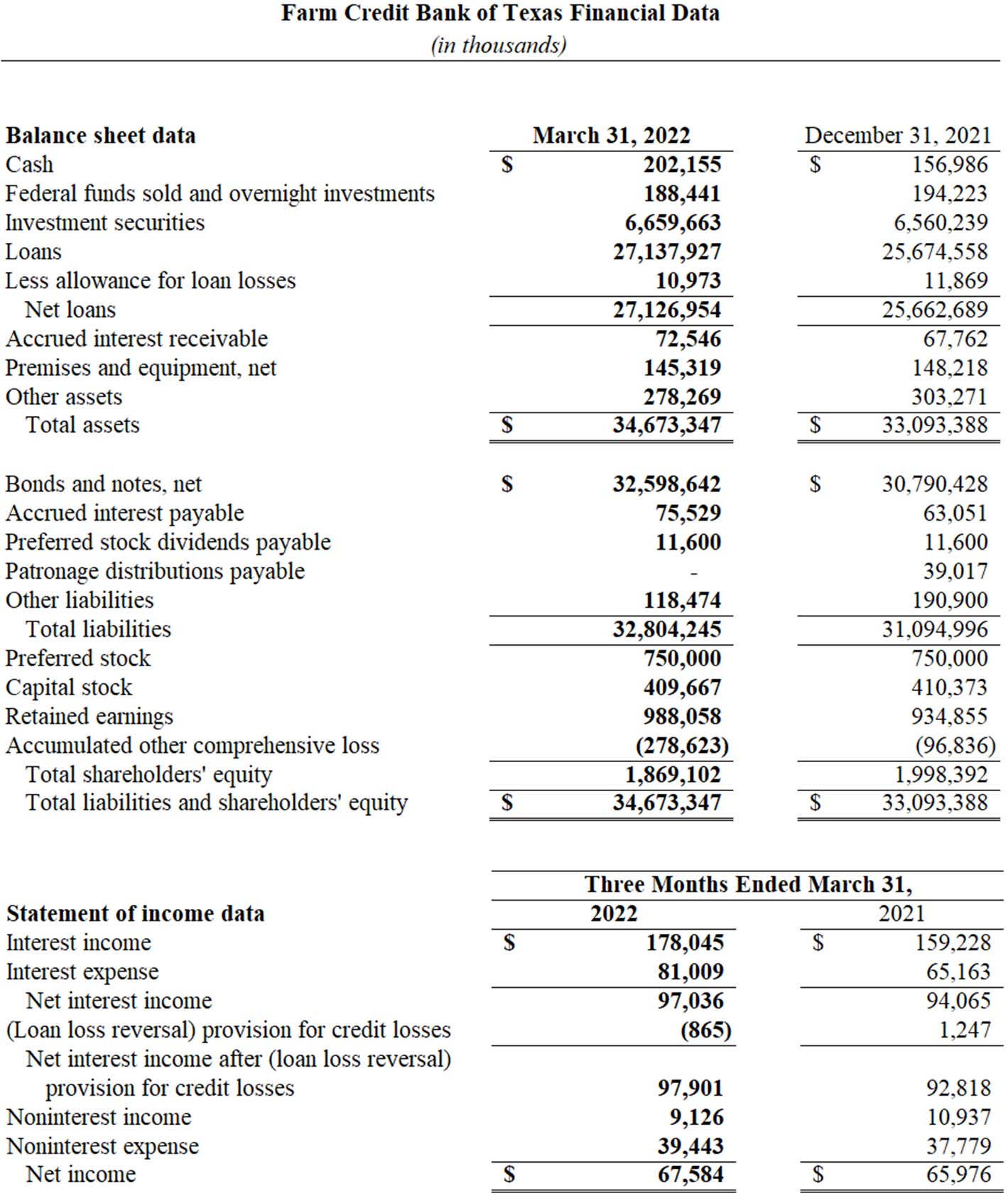

First quarter net income was $67.6 million, a 2.4% increase compared with the same period of 2021. Net interest income for the quarter was $97 million, a 3.2% increase year over year primarily driven by growth in interest earning assets.

Total assets increased 4.8% in the first quarter to $34.7 billion as of March 31, 2022, with total loan volume increasing 5.7% to $27.1 billion. The loan portfolio’s credit quality remained high, with 99.9% of loans classified as acceptable or special mention.

“Growth in the bank’s loan portfolios once again surpassed projections, contributing to strong earnings,” said Amie Pala, FCBT chief executive officer. “Our double-digit growth in loan participations in the first quarter was among the highest we’ve seen, due in part to seasonal demand for agribusiness financing as well as higher commodity prices. Direct notes to our affiliated lenders also grew, reflecting strong loan demand in our five-state territory.”

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America. Headquartered in Austin, it funds 14 local lending cooperatives and two other financing institutions so they can make loans to farmers, ranchers, agribusinesses and rural property owners. The bank also participates with other lenders in capital markets loans to agribusinesses and rural infrastructure providers.

“Spring is a busy season for agricultural producers and the bank’s affiliated lenders that serve them,” FCBT Board Chair Jimmy Dodson said. “The bank’s strong financial performance and access to low-cost funding position it well to meet their needs for dependable credit.”

At the end of the first quarter the bank had $1.9 billion in shareholders’ equity and a total capital ratio of 13.74%. Cash and investments totaled $7.1 billion, providing ample liquidity and exceeding regulatory requirements.

The bank is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. The System reported combined net income of $1.8 billion for the three months ending March 31, 2022, compared with $1.7 billion for the same period last year.

These financial results are preliminary and unaudited. The bank will post its 2022 first quarter report at https://www.farmcreditbank.com/financials/bank-financial-reports.