AUSTIN, Texas – August 1, 2025 – Farm Credit Bank of Texas (FCBT) reported solid earnings, loan growth, and sustained credit quality in the second quarter and first half of 2025.

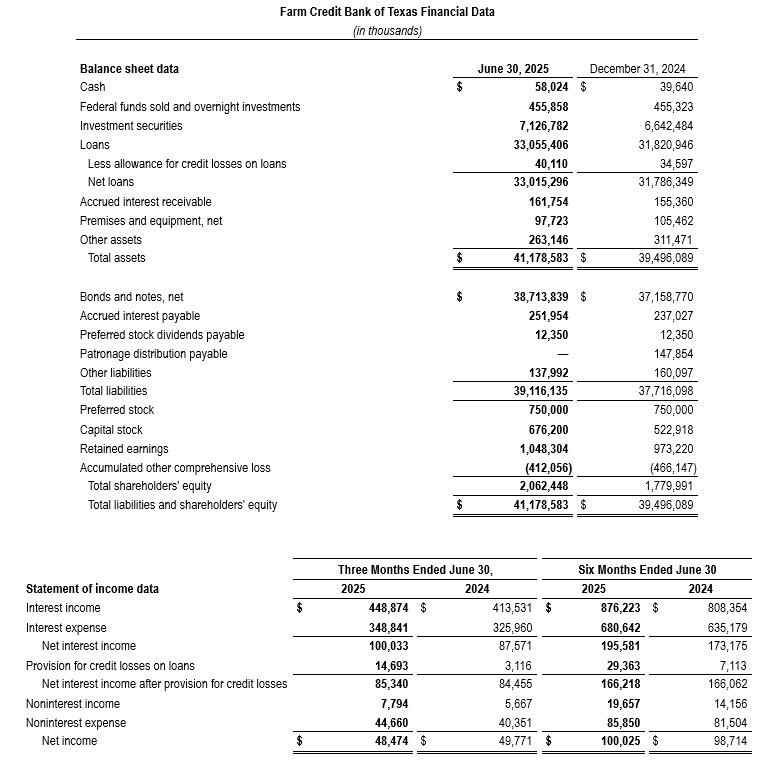

Net income was $48.5 million and $100.0 million for the three months and six months ended June 30, 2025; decreasing 2.6% and increasing 1.3%, respectively, compared with the same periods of 2024. For the three-month period, the decrease in net income was driven by higher provision for credit losses and noninterest expense, partially offset by growth in net interest income and noninterest income. For the six-month period, the increase in net income was driven by growth in net interest income and noninterest income, partially offset by higher provision for credit losses and noninterest expense.

Net interest income was $100.0 million for the quarter and $195.6 million year to date; up 14.2% and 12.9%, respectively, compared with the same periods of the prior year. The increases were driven by growth in the bank’s average interest-earning assets and improvements in the net interest rate spread.

“Despite ongoing market uncertainties in the second quarter, our financial performance remained stable and consistent with our strategic outlook,” said Amie Pala, FCBT chief executive officer. “With inflationary trends and interest rate changes continuing to impact both lenders and borrowers, our strong liquidity, capital reserves, and disciplined credit risk management provide a solid foundation amid today’s complex economic environment.”

The bank recorded a provision for credit losses of $14.7 million for the second quarter of 2025, primarily driven by specific reserves for loans in the agribusiness and production and intermediate-term sectors. The year to date provision for credit losses was $29.4 million, reflecting specific reserves in these sectors as well as increased general reserves related to credit deterioration in agribusiness and real estate mortgage loans.

In July, the bank issued $350 million of Class B Series 6 perpetual noncumulative subordinated preferred stock. Strong investor demand allowed the bank to price the offering at 7.00%. Preferred stock remains an important part of the bank’s capital strategy and supports continued district growth.

Total loan volume increased 3.9% from year-end 2024 to $33.1 billion at June 30, 2025, primarily reflecting growth in direct notes to the bank’s affiliated lending institutions and the capital markets loan portfolio. Total assets increased 4.3% to $41.2 billion. Nonperforming assets, which consisted of nonaccrual loans, accruing loans 90 days or more past due and other property owned, remained low at 0.12% of total loans and other property owned, compared with 0.15% at year-end 2024. Overall credit quality remained strong, with 99.5% of loans classified as acceptable or special mention.

“Loan activity remained steady in the second quarter, reflecting the ongoing credit needs of farmers and rural businesses,” said Jimmy Dodson, FCBT board chair. “Our financial stability and continued focus on our mission help ensure that rural communities have consistent access to financing.”

At the end of the second quarter, the bank had $2.1 billion in shareholders’ equity and a total capital ratio of 13.49%. Cash and investments totaled $7.6 billion, providing ample liquidity and exceeding regulatory requirements.

The bank is part of the Farm Credit System, a nationwide network of customer-owned financial institutions established in 1916. The System reported combined net income of $1.94 billion and $3.90 billion for the three months and six months ended June 30, 2025, compared with $1.93 billion and $3.92 billion for the same periods of the prior year.

These financial results are preliminary and unaudited. The bank will post its second quarter 2025 report at www.farmcreditbank.com/financials/bank-financial-reports.

About Farm Credit Bank of Texas

Farm Credit Bank of Texas is a cooperatively owned wholesale bank that finances agriculture and rural America within the Texas Farm Credit District. It funds 12 affiliated associations and two other financing institutions, enabling them to make loans to farmers, ranchers, agribusinesses, and rural property owners. It also partners with other lenders to finance agricultural production and processing, essential rural infrastructure and more. The bank is part of the Farm Credit System, the nation’s oldest and largest source of rural financing.