Lending Partnerships

Farm Credit Bank of Texas is an efficient and reliable lending partner with a strong credit rating and financial stability, acting as a single point of contact for originators seeking large commitments.

Syndications & Participations

Farm Credit Bank of Texas (FCBT) partners with other Farm Credit System (FCS) banks and associations, regional banks, commercial banks, and other financial institutions in loan syndications and participations, combining diverse attributes to fund complex financial transactions.

Not a Competitor

FCBT does not originate loans. FCBT serves as a reliable syndication and participation partner for funding complex financial transactions.

No Ancillary Business Required

Our lending approach is designed to maximize loan volume without the need for ancillary business requirements. We specialize in a wide range of financing options, including senior secured and unsecured Revolving Lines of Credit (RLOCs), Term Loans (TL-A, TL-B), corporate bonds, project financing, and private placements.

Large Commitments

With strong credit ratings and a history of financial stability, FCBT serves as a single point of contact for originators seeking large commitments for national and multinational businesses.

Efficient Approval Process

Our broad industry experience allows us to quickly assess potential financing transactions and provide rapid indicative interest. Our streamlined approval process ensures efficient decision-making, offering you the clarity and confidence to partner with us.

Preliminary Indication

2-3 Business Days*

Formal Approval

1-2 Weeks*

*Timeframes may vary

Our Strength

$41.7B

Total Assets as of 9/30/2025

Wholesale Bank

Credit Ratings

Moody’s

Aa3

Fitch Rating

A+

Total Exposure

Sold

$4.5B

Retained

$13.3B

As of 12/31/2024

Agricultural Expertise

We have broad knowledge and experience in evaluating agricultural projects, understanding borrower needs, identifying risks, and structuring a variety of financial transactions.

Our deep understanding of the agricultural sector complements the financial capabilities of large origination banks, making us a valuable lending partner. Together we can provide comprehensive and flexible financial solutions that help develop and grow agricultural businesses and support the sustainability of the American economy.

Portfolio Diversity

FCBT provides credit and other financial services to companies across a wide range of industries that support American agriculture and rural communities.

Ag Inputs

Protein Production & Processing

Crop Production & Processing

Food & Beverage Manufacturers

Food & Beverage Logistics

Timberland & Forest Products

Other

Learn more about Farm Credit Bank of Texas

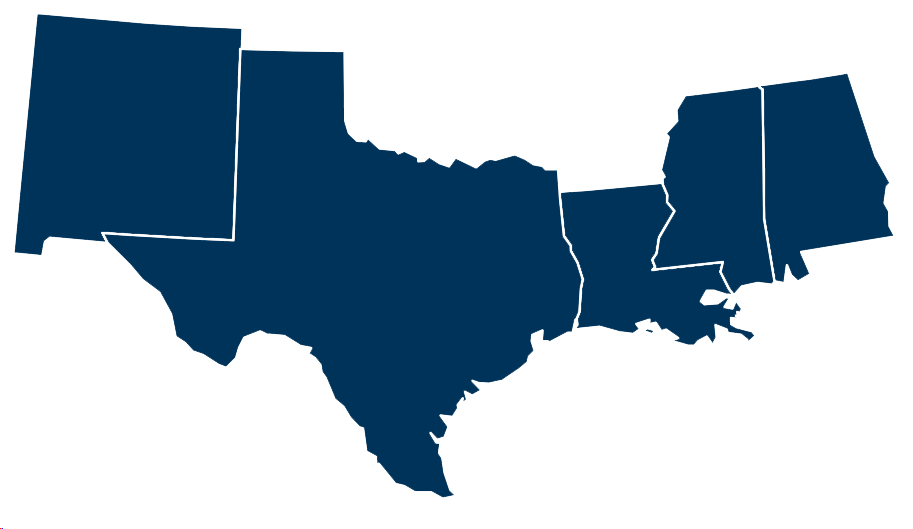

Our Business Model

We provide funding and services to 12 lending co-ops that finance rural real estate, agribusiness, and agricultural production. We’re also active in the capital markets, participating in large loans to agribusiness companies and rural infrastructure providers.

$139.7MILLION net income 9/30/2025 |

$41.7BILLION total assets 9/30/2025 |

$33.6BILLION loan volume 9/30/2025 |

Meet the Team

Aaron Wiechman

Chief Lending Officer

Roger Leesman

Managing Director

Todd Erickson

Senior Director

Laura Mizzen

Senior Director

Luis Requejo

Senior Director

Katrina Lange

Director

Mandy Valdes

Director

Natalie Mueller

Director

Paul Guimaraes

Syndications Officer

Stephany Haberstroh

Portfolio Manager

Lalo Jasso

Portfolio Manager

Ina Sills

Portfolio Manager

Work with us

Your partner in ag lending

Contact the Capital Markets Team

|

|

|