Farm Credit Bank of Texas Reports Third Quarter 2016 Financial Results

For Immediate Release November 3, 2016

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a cooperatively owned wholesale funding bank that supports agriculture and rural communities, reported stable assets and credit quality for the third quarter of 2016.

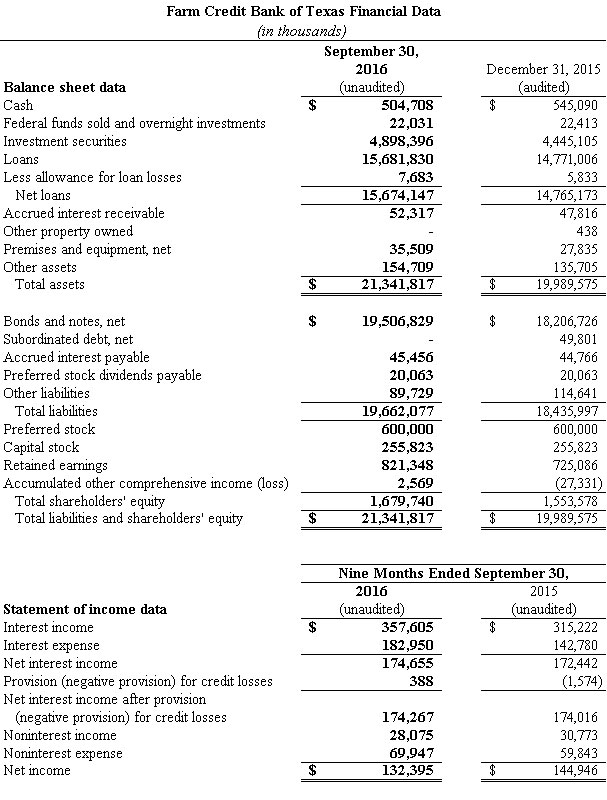

Total assets were $21.3 billion at Sept. 30, 2016, a 6.8 percent increase since year-end. The bank’s $15.7 billion in total loan volume remained near the record of the prior quarter while maintaining very high credit quality.

The bank’s assets include highly diversified loans and investments. It funds locally owned Farm Credit lending cooperatives that provide financing and related services to farmers, ranchers and other rural borrowers in a five-state territory. In addition, it participates with other lenders in loans to businesses that ag producers and rural communities rely on, such as food processors, agribusinesses and rural infrastructure companies.

“Our assets grew at a moderate pace in the third quarter following nearly two years of strong growth,” said Larry Doyle, FCBT chief executive officer. “Credit quality is solid, and our earnings have remained strong even as interest rate spreads have narrowed on loans. The bank took advantage of the low interest rate environment by calling $7.5 billion in debt in the first nine months of the year and issuing new debt at lower rates, which increased this year’s interest expense but will reduce interest expense going forward.”

Bank net income decreased 3.3 percent and 8.7 percent for the three months and nine months ended Sept. 30, 2016, compared with the same periods in the prior year. The change is due largely to nonrecurring events in 2015, such as large prepayment fees and a gain on the sale of acquired property, and to higher operating expenses in 2016, including higher insurance premiums on outstanding debt as a result of premium rate increases and recent asset growth.

The bank maintained strong capital and liquidity levels, exceeding regulatory requirements set by its federal regulator, the Farm Credit Administration. At Sept. 30, 2016, it had $1.7 billion in shareholders’ equity and a permanent capital ratio of 17.1 percent. Cash and investments totaled $5.4 billion, providing 198 days of liquidity.

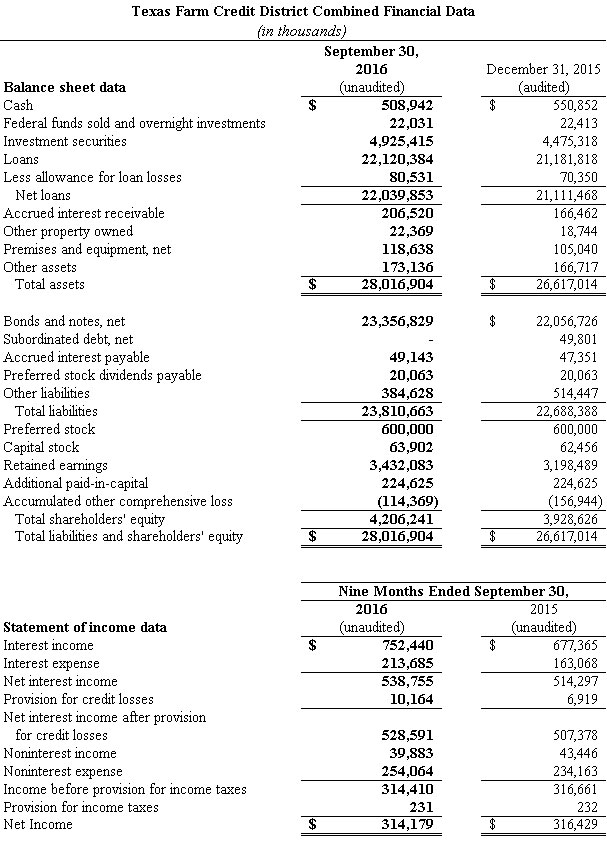

Together, the bank and 14 affiliated cooperatives across Alabama, Louisiana, Mississippi, New Mexico and Texas constitute the Texas Farm Credit District. Loan volume and total assets for the bank and district institutions combined increased slightly to record levels at the end of the quarter. The credit quality across the district remained strong.

“Our financial performance in the third quarter stayed on target with our plan,” said FCBT Board Chairman Jimmy Dodson. “District lenders are somewhat insulated from the effects of a recent drop in prices for some commodities because of our diversified territory. We’re pleased that our success has positioned us to provide the credit that agriculture needs to remain successful.”

District net interest income increased 5 percent for the three months and nine months ended Sept. 30, 2016, compared with the same periods of the prior year. Combined net income decreased slightly, reflecting an increase in provision for loan losses, due in part to loan growth; higher operating expenses; and lower noninterest income, due in part to nonrecurring events in 2015.

The district is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. Nationally, the System reported combined net income of $1.3 billion and $3.6 billion for the three-month and nine-month periods ended Sept. 30, 2016, compared with $1.2 billion and $3.5 billion for the same periods in 2015.

The bank, district and System results discussed herein are preliminary and unaudited. The bank’s financial statements and the combined statements of the Texas District for the quarter ended Sept. 30, 2016, are expected to be available on or about Nov. 9, 2016.