Farm Credit Bank of Texas Reports Strong Loan Growth in First Quarter

For immediate release: May 3, 2019

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT), a wholesale bank that funds Farm Credit lending cooperatives in five states, reported strong loan growth, stable earnings and strong credit quality in the first quarter of 2019.

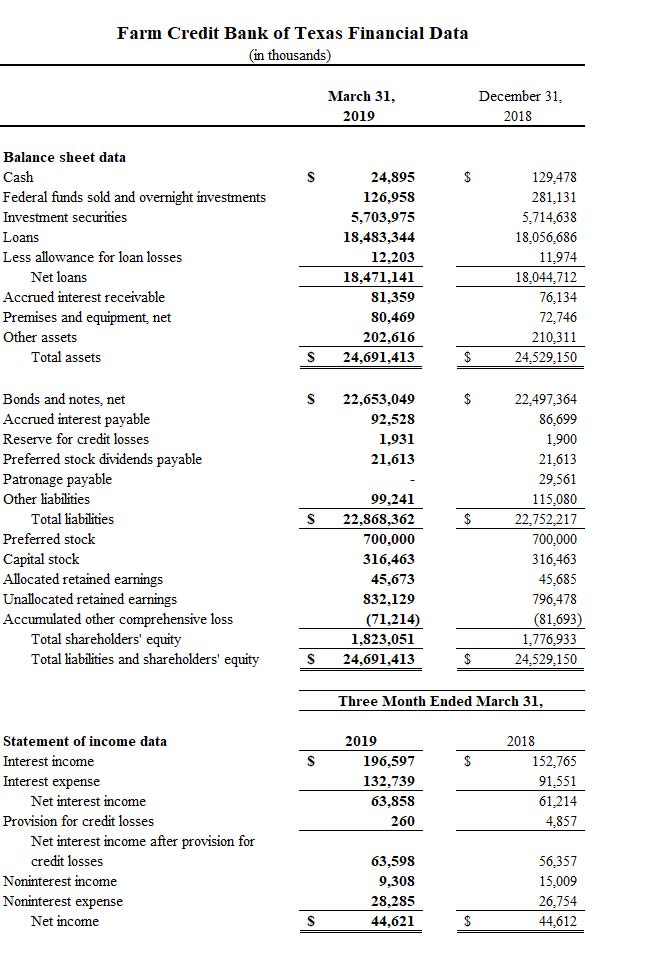

Total loan volume increased 2.4% in the first quarter to a record $18.5 billion at March 31, 2019. Total assets reached a record $24.7 billion. Credit quality remained very strong, with 99.4% of loans classified as acceptable or special mention.

“Growth was excellent across our loan portfolios, supporting steady earnings in a very challenging market environment,” said Larry Doyle, FCBT chief executive officer. “The bank called $765 million in debt and issued new debt at lower rates, which will benefit the bank in the future.”

First-quarter net interest income totaled $63.9 million. The 4.3% increase year over year reflects a $1.6 billion increase in average earning assets, which offset a decrease in net interest rate spread of 7 basis points. Net income increased slightly year over year to $44.6 million at March 31, 2019.

The bank provides funding and support services to 14 Farm Credit cooperatives — also called associations — and two other financing institutions in Alabama, Louisiana, Mississippi, New Mexico and Texas. Those lenders, in turn, provide credit and financial services to farmers, ranchers, rural homeowners, landowners and agribusinesses.

“This is the time of year when our affiliated associations return a portion of their prior year’s earnings to their borrowers in the form of patronage payments,” said FCBT Board Chairman Jimmy Dodson. “Patronage is one of the ways Farm Credit carries out its mission to support agriculture and rural communities. It’s a unique benefit of doing business with a lending cooperative that effectively lowers the members’ borrowing costs.”

At the end of the first quarter, the bank had a total capital ratio of 16.0% and shareholders’ equity of $1.8 billion. Cash and investments totaled $5.9 billion and provided 227 days of liquidity.

The bank is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. The System reported combined net income of $1.29 billion for the first quarter of 2019, compared with $1.27 billion a year earlier.

The financial results discussed herein are preliminary and unaudited.