Farm Credit Bank of Texas Distributes Majority of Record 2020 Earnings

FOR IMMEDIATE RELEASE: February 25, 2021

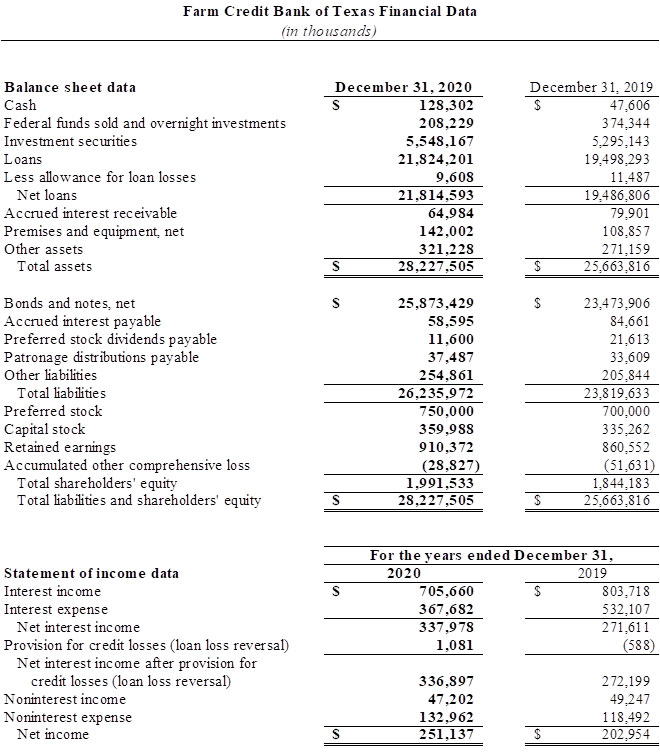

AUSTIN, Texas – Farm Credit Bank of Texas (FCBT) reported a record $251.1 million in net income in 2020. It distributed 85.5% of its earnings to its stockholders and lending partners in the form of patronage payments and other dividends.

The cooperatively owned bank provides funding and support services to 14 Farm Credit lending cooperatives — also called associations — and two other financing institutions. It also participates with other lenders in loans to agribusinesses and rural infrastructure providers.

Patronage is one way cooperatives distribute earnings. Based on its solid earnings and capital position in 2020, the bank declared a record $159.9 million in patronage. It also distributed $54.8 million in preferred stock dividends.

“Our robust patronage payments reduce funding costs for our affiliated lenders,” said Amie Pala, FCBT chief executive officer. “We took advantage of low interest rates in 2020 by calling $16.2 billion in debt and issuing new debt at lower rates. We also continued to provide new technology and services, absorbing the cost, to help associations serve their local borrowers.”

Loan demand was strong in the bank’s five-state territory, fueled by low interest rates and a diverse agriculture industry. In 2020, the bank’s total loan volume increased 11.9% to $21.8 billion. Total assets increased 10.0% to a record $28.2 billion. Credit quality remained high, with 100% of loans classified as acceptable or special mention.

The bank carries ample cash and liquidity investments to meet its operational needs — and those of the associations and their borrowers. At the end of 2020, it had $5.9 billion in cash and investments, $2.0 billion in shareholders’ equity and a total regulatory capital ratio of 16.15%.

By providing reliable and consistent access to credit, the bank continues to fulfill its mission to support agriculture and rural communities during these unprecedented times. It also is closely monitoring the overall impact of COVID-19 as it evolves.

“The bank was nimble and adaptable in a very challenging year,” said Jimmy Dodson, FCBT board chair. “It achieved strong earnings despite very low interest rates. And its support services helped associations operate safely and meet borrowers’ needs during the pandemic.”

The bank is part of the Farm Credit System, a nationwide network of cooperatives established in 1916. The System reported combined net income of $6.0 billion for the year ended Dec. 31, 2020, compared with $5.4 billion the prior year.

The financial results discussed here are preliminary and unaudited. The bank will post its 2020 annual report at www.farmcreditbank.com/financials/bank-financial-reports.